Progressivity in United States income tax

As a group, the lowest earning workers, especially those with dependents, pay no income taxes and may actually receive a small subsidy from the federal government (from child credits and the Earned Income Tax Credit).

In the words of Piketty and Saez, "... the progressivity of the U.S. federal tax system at the top of the income distribution has declined dramatically since the 1960s".

[3] They continue, "... the most dramatic changes in federal tax system progressivity almost always take place within the top 1 percent of income earners, with relatively small changes occurring below the top percentile."

When simply comparing Market Income to After Tax Income, due to Government Transfers the Net Federal Tax burden of the median taxpayer has declined from 13.94% in 1979 to -8.76% in 2010 - this metric became negative for the first time in 2008.

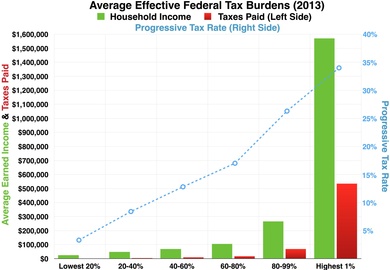

The CBO report in 2013 shows the share of federal taxes paid by taxpayers of various income levels.

Based on the data provided by the CBO, the resulting Net Tax liability as compared to income is presented in the accompanying charts.

As of 2010, the bottom 99% by Market Income taken as a group had a negative Net Federal Tax burden, while the top 1 percent by Market Income paid in the aggregate 101% of Net Federal Taxes.

[9] The National Bureau of Economic Research has concluded that the combined federal, state, and local government average marginal tax rate for most workers to be about 40% of income.

Higher income households are subject to the Alternative Minimum Tax that limits deductions and sets a flat tax rate of 26% to 28% with the higher rate commencing at $175,000 in income.

The net effect is increased progressivity that completely limits deductions for state and local taxes and certain other credits for individuals earning more than $306,300.

Much of the earnings of those in the top income bracket come from capital gains, interest and dividends, which are taxed at 15 percent.

In recent years, a reduction in the tax rates applicable to capital gains and received dividends payments, has significantly reduced the tax burden on income generated from savings and investing.

An argument is often made that these types of income are not generally received by low-income taxpayers, and so this sort of "tax break" is anti-progressive.

Further clouding the issue of progressivity is that far more deductions and tax credits are available to higher-income taxpayers.

Allowable itemized deductions include payments to doctors, premiums for medical insurance, prescription drugs and insulin expenses, state taxes paid, property taxes, and charitable contributions.

In those two scenarios, assuming no other income, the tax calculations would be as follows for a single taxpayer with no dependents in 2006: This would appear to be highly progressive - the person with the higher taxable income pays tax at twice the rate.

When an individual's Social Security benefit is calculated, income in excess of each year's Social Security Tax wage base amount is disregarded for purposes of the calculation of future benefits.

Another example is excise taxes, e.g. on gasoline, which may be paid from throughout the economy without recording individual contributions.