Reverse auction

Reverse auctions can also be used to reveal private opportunity cost information, which can be useful in the design of incentive programs to correct market failures and promote the provisioning of public goods, common-pool resources, and non-market ecosystem services, for example.

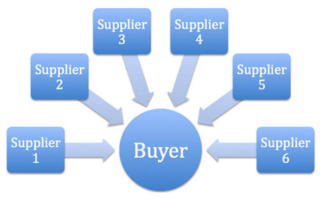

[2][3] Another common application of reverse auctions is for e-procurement, a purchasing strategy used for strategic sourcing and other supply management activities.

This helps achieve rapid downward price pressure that is not normally attainable using traditional static paper-based bidding processes.

[citation needed] Reverse auctions are used to fill both large and small value contracts for both public sector and private commercial organizations.

The first time this occurred was in August 2001, when America West Airlines (which later became US Airways) used FreeMarkets software and awarded the contract to MaterialNet.

In 2003, researchers claimed an average of five percent of total corporate spending was sourced using reverse auctions.

[7] They have been found to be more appropriate and suitable in industries and sectors like advertising, auto components, bulk chemicals, consumer durables, computers and peripherals, contract manufacturing, courier services, FMCG, healthcare, hospitality, insurance, leasing, logistics, maritime shipping, MRO, retail, software licensing, textiles, tourism, transport and warehousing.

[4] The pioneer of online e-procurement reverse auctions in the United States, FreeMarkets, was founded in 1995 by former McKinsey & Company consultant and General Electric executive Glen Meakem after he failed to find internal backing for the idea of a reverse auction division at General Electric.

FreeMarkets customers included BP, United Technologies, Visteon, Heinz, Phelps Dodge, ExxonMobil, and Royal Dutch Shell, to name a few.

[citation needed] Although FreeMarkets survived the winding down of the dot-com boom, by the early-2000s, it was apparent that its business model was really like an old-economy consulting firm with some sophisticated proprietary software.

Online reverse auctions started to become mainstream and the prices that FreeMarkets had commanded for its services dropped significantly.

[8] Fortune published an article in March 2000, describing the early days of internet-based reverse auctions.

[citation needed] In congressional testimony on the 2008 proposed legislative package to use federal funds to buy toxic assets from troubled financial firms, Federal Reserve Chairman Ben Bernanke proposed that a reverse auction could be used to price the assets.

[13] In 2010, The White House Office of Management and Budget cited "continued implementation of innovative procurement methods, such as the use of web-based electronic reverse auctions" as one of the contracting reforms helping agencies meet acquisition savings goals.

The literature on buyer-determined auctions is often empirical in nature and is concerned with identifying the unannounced implicit scoring function the buyer uses.

This is typically done through a discrete choice model, wherein the econometrician uses the observed attributes, including price, and maps them to the probability of being chosen as the winner.

Unlike scoring auctions, there is no pre-announced or binding weight on each quality attribute that will determine the winner in a formal fashion.

Martin Ricketts writes that "under competitive conditions, the bid prices should fall until they just enable firms to achieve a normal return on capital.

[26] Although the history of the Japanese reverse auction is unknown, they are widely used in the world of business-to-business procurement as a form of cost negotiation.

The benefits of the Japanese reverse auction are based on the fact that the buying organization has greater transparency to the actual market itself.

In this regard, the format more closely mirrors that of a traditional reverse auction by providing greater visibility to each participant's lowest offer.