Federal Reserve

[6][11] Congress established three key objectives for monetary policy in the Federal Reserve Act: maximizing employment, stabilizing prices, and moderating long-term interest rates.

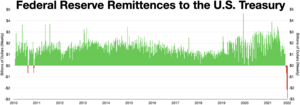

[22] The federal government sets the salaries of the board's seven governors, and it receives all the system's annual profits after dividends on member banks' capital investments are paid, and an account surplus is maintained.

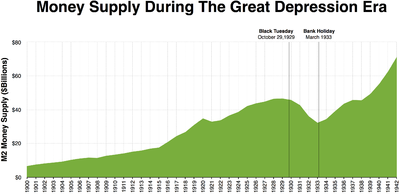

The System, then, was to provide not only an elastic currency—that is, a currency that would expand or shrink in amount as economic conditions warranted—but also an efficient and equitable check-collection system.In the United States, the Federal Reserve serves as the lender of last resort to those institutions that cannot obtain credit elsewhere and the collapse of which would have serious implications for the economy.

This contributes to the effective functioning of the banking system, alleviates pressure in the reserves market and reduces the extent of unexpected movements in the interest rates.

In 2006 Donald L. Kohn, vice chairman of the board of governors, summarized the history of this compromise:[41] Agrarian and progressive interests, led by William Jennings Bryan, favored a central bank under public, rather than banker, control.

They frequently testify before congressional committees on the economy, monetary policy, banking supervision and regulation, consumer credit protection, financial markets, and other matters.

For depository institutions, they maintain accounts and provide various payment services, including collecting checks, electronically transferring funds, and distributing and receiving currency and coin.

[47] In the Depository Institutions Deregulation and Monetary Control Act of 1980, Congress reaffirmed that the Federal Reserve should promote an efficient nationwide payments system.

The Federal Reserve plays a role in the nation's retail and wholesale payments systems by providing financial services to depository institutions.

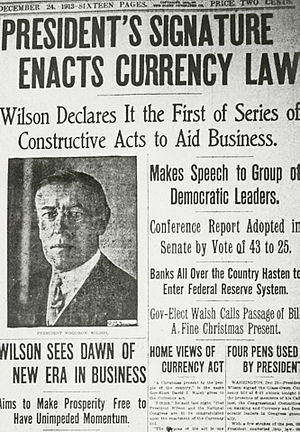

[25] The System does not require public funding, and derives its authority and purpose from the Federal Reserve Act, which was passed by Congress in 1913 and is subject to Congressional modification or repeal.

[55] The current members of the board of governors are:[53] In late December 2011, President Barack Obama nominated Jeremy C. Stein, a Harvard University finance professor and a Democrat, and Jerome Powell, formerly of Dillon Read, Bankers Trust[56] and The Carlyle Group[57] and a Republican.

[56] "Obama administration officials [had] regrouped to identify Fed candidates after Peter Diamond, a Nobel Prize-winning economist, withdrew his nomination to the board in June [2011] in the face of Republican opposition.

Richard Clarida, a potential nominee who was a Treasury official under George W. Bush, pulled out of consideration in August [2011]", one account of the December nominations noted.

[63] However, Senate leaders reached a deal, paving the way for affirmative votes on the two nominees in May 2012 and bringing the board to full strength for the first time since 2006[64] with Duke's service after term end.

Later, on January 6, 2014, the United States Senate confirmed Yellen's nomination to be chair of the Federal Reserve Board of Governors; she was the first woman to hold the position.

At the time of the announcement, the FOMC "already is down three members as it awaits the Senate confirmation of ... Fischer and Lael Brainard, and as [President] Obama has yet to name a replacement for ... Duke.

Formal meetings typically are held eight times each year in Washington, D.C. Nonvoting Reserve Bank presidents also participate in Committee deliberations and discussion.

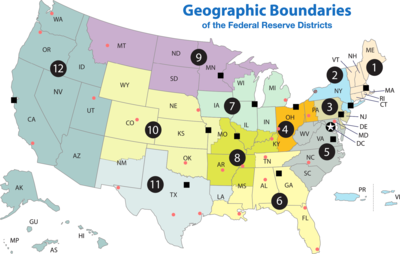

They are located in Boston, New York, Philadelphia, Cleveland, Richmond, Atlanta, Chicago, St. Louis, Minneapolis, Kansas City, Dallas, and San Francisco.

By easening or tightening the stance of monetary policy, i.e. lowering or raising its target for the federal funds rate, the Fed can either spur or restrain growth in the overall US demand for goods and services.

[93][92] However, open market operations are still an important maintenance tool in the overall framework of the conduct of monetary policy as they are used for ensuring that reserves remain ample.

[93] To smooth temporary or cyclical changes in the money supply, the desk engages in repurchase agreements (repos) with its primary dealers.

When the transaction matures, the process unwinds: the Fed returns the collateral and charges the primary dealer's reserve account for the principal and accrued interest.

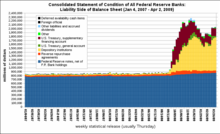

[101] Fed Chair Ben S. Bernanke, testifying before the House Committee on Financial Services, stated that the Term Deposit Facility would be used to reverse the expansion of credit during the Great Recession, by drawing funds out of the money markets into the Federal Reserve Banks.

[1] In order to address problems related to the subprime mortgage crisis and United States housing bubble, several new tools were created.

A revision crafted during a secret meeting on Jekyll Island by Senator Aldrich and representatives of the nation's top finance and industrial groups later became the basis of the Federal Reserve Act.

Paul Warburg, an attendee of the meeting and longtime advocate of central banking in the U.S., later wrote that Aldrich was "bewildered at all that he had absorbed abroad and he was faced with the difficult task of writing a highly technical bill while being harassed by the daily grind of his parliamentary duties".

[5][152] In contrast, progressive Democrats favored a reserve system owned and operated by the government; they believed that public ownership of the central bank would end Wall Street's control of the American currency supply.

[159] The net worth of households and nonprofit organizations in the United States is published by the Federal Reserve in a report titled Flow of Funds.

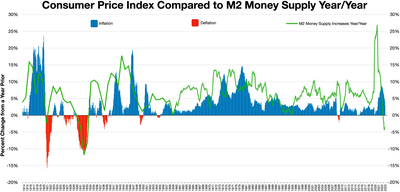

[163] Although the Fed is not required to maintain inflation within a specific range, their long run target for the growth of the PCE price index is between 1.5 and 2 percent.

[166] Chief economist, and advisor to the Federal Reserve, the Congressional Budget Office and the Council of Economic Advisers,[167][168] Diane C. Swonk observed, in 2022, that "From the Fed's perspective, you have to remember inflation is kind of like cancer.