Federal Insurance Contributions Act

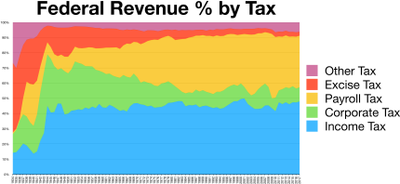

The Federal Insurance Contributions Act (FICA /ˈfaɪkə/) is a United States federal payroll (or employment) tax payable by both employees and employers to fund Social Security and Medicare[1]—federal programs that provide benefits for retirees, people with disabilities, and children of deceased workers.

The Federal Insurance Contributions Act is a tax mechanism codified in Title 26, Subtitle C, Chapter 21 of the United States Code.

The amount that one pays in payroll taxes throughout one's working career is associated indirectly with the social security benefits annuity that one receives as a retiree.

FICA therefore behaves as a tax for all practical purposes, earmarked for particular uses by Congress but fully subject to Congressional authority, including redirection.

Since 1990, the employee's share of the Social Security portion of the FICA tax has been 6.2% of gross compensation up to a limit that adjusts with inflation.

There are some limited cases, such as a successor-predecessor employer transfer, in which the payments that have already been withheld can be counted toward the year-to-date total.

[13] SECA requires self-employed individuals in the United States to pay Social Security and Medicare taxes.

[17] In order to be exempt from FICA payroll taxes, a student's work must be "incident to" the pursuit of a course of study, which is rarely the case with full-time employment.

[18] Medical residents working full-time are not considered students and are not exempt from FICA payroll taxes, according to a United States Supreme Court ruling in 2011.

[18] A student enrolled and regularly attending classes at a school, college, or university who performs work as a cook, waiter, butler, maid, janitor, laundress, furnaceman, handyman, gardener, housekeeper, housemother, or similar duties in or around the club rooms or house of a local college club, or in or about the club rooms or house of a local chapter of a college fraternity or sorority, are exempt from FICA tax.

[28] In order to apply to become exempt from paying FICA tax under this provision, the person must file Form 4029, which certifies that the person:[29] People who claim the above exemption must agree to notify the Internal Revenue Service within 60 days of either leaving the religious group or no longer following the established teachings of the religious group.

[30] In order to relieve a person of double-taxation, the certain countries and the United States have entered into tax treaties, known as totalization agreements.

[30] Countries who have such a tax treaty with the United States include Australia,[31] Austria,[32] Belgium,[33] Canada,[34] Chile,[35] Czech Republic,[36] Denmark,[37] Finland,[38] France,[39] Germany,[40] Greece,[41] Hungary, [42] Ireland,[43] Japan,[44] Luxembourg,[45] Netherlands,[46] Norway,[47] Poland,[48] Portugal,[49] Slovakia,[50] South Korea,[51] Spain,[52] Sweden,[53] Switzerland,[54] and United Kingdom.

[63] Payments are not exempt from FICA tax if the program's primary purpose is to increase an individual's chances of employment by providing training and work experience.

[67][68] In order to qualify for the exemption from FICA tax, the employee must have been hired to work temporarily in connection with an unforeseen emergency, such as an individual temporarily hired to battle a major forest fire, to respond to a volcano eruption, or to help people affected by a severe earthquake or flood.

In 2014, the Supreme Court unanimously held in United States v. Quality Stores, Inc. that severance pay is taxable wages for FICA purposes.

[74] In August 2020, President Donald Trump signed an executive order to temporarily suspend collection of the tax from September to December 2020.

In other words, for wage levels above the limit, the absolute dollar amount of tax owed remains constant.

Others, including The Economist and the Congressional Budget Office, point out that the Social Security system as a whole is progressive in the lower income brackets.