Energy in Singapore

This location has established Singapore as a central hub for the global petroleum, petrochemical, and chemical industries, with Jurong Island serving as a key base for over 100 international companies in these sectors.

[2] In addition to legislative measures, the Singapore Green Plan has been developed to set forth clear objectives for environmental improvement and sustainability.

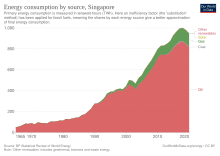

[8] In 2021, Singapore's oil supply totaled 1,027,948 terajoules, a 42% increase from 2000, comprising both crude and refined products, net of exports and storage.

[11][12] In 2008, BG Group (which merged with Shell in 2016) won an exclusive franchise to supply as much as 3 million tonnes per annum (mpta) of LNG.

[13] Energy Market Authority (EMA) subsequently launched a competitive Request for Proposal process in 2014 which saw Shell Eastern and Pavilion Gas being appointed LNG importers in 2016.

[15] In 2021, Singapore's natural gas imports showed a staggering increase, climbing by 754% since 2000, with the entire supply sourced from international markets.

This total reliance on external sources poses significant energy security concerns, heightened by global events such as Russia’s invasion of Ukraine.

CO2 emissions from natural gas were 22.528 million tonnes in 2021, up by 684% from 2000, highlighting the need for stringent environmental management despite its status as a cleaner alternative to coal and oil.

[16] The biggest palm oil-based diesel plant in the world, 800,000 t/a production, started operations in Singapore at the end of 2010 by Neste Oil from Finland.

[18] According to European Union studies the increased demand for palm oil inevitably leads to new plantations being established in the forests and peat land areas.

Land use changes have large green house gas emissions making palm oil diesel much more harmful than petroleum in respect to global warming.

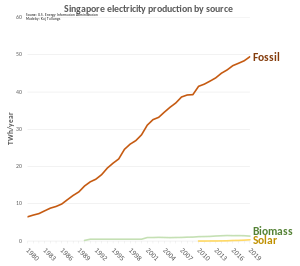

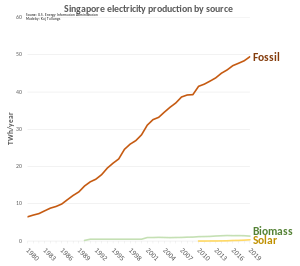

Natural gas remains a key fuel for Singapore's power generation as it scales up efforts to harness solar and develop other low-carbon technologies.

[28] Singapore set a target of generating solar power to cover 350,000 households in 2030 that would correspond to 4% of the country's electricity demand in 2020.

[30] Under the Singapore Green Plan, the country aims to achieve 2 gigawatt-peak of solar by 2030, equivalent to powering around 350,000 households a year.

[31] Singapore also aims to deploy 200 megawatts (MW) of energy storage systems beyond 2025 to mitigate solar intermittency and reduce peak demand.

[40] Singapore is also studying different low-carbon technologies such as hydrogen, carbon capture, utilisation and storage and geothermal energy for possible adoption in the longer term.

EMA planned to follow up with a Request for Proposal to assess the viability and scalability of deploying geothermal systems in Singapore.

[52][53] To address its rising electricity demand, driven by sectors such as advanced manufacturing and transport, Singapore is focusing on enhancing its generation capacity.

In 2024, the EMA initiated a request for proposals to build and operate two new hydrogen-ready gas-fired power plants, each with a minimum capacity of 600 megawatts.

Scheduled to start operations in 2029 and 2030, respectively, these facilities are integral to Singapore's comprehensive strategy to meet an anticipated peak power demand of 11.8 gigawatts by 2030.

This effort underscores the nation's commitment to maintaining a reliable and adequate electricity supply for its expanding economy and population.