Sovereign wealth fund

These are assets of the sovereign nations that are typically held in domestic and different reserve currencies (such as the dollar, euro, pound, and yen).

Sovereign wealth funds can be characterized as maximizing long-term return, with foreign exchange reserves serving short-term "currency stabilization", and liquidity management.

Many central banks in recent years possess reserves massively in excess of needs for liquidity or foreign exchange management.

Moreover, it is widely believed most have diversified hugely into assets other than short-term, highly liquid monetary ones, though almost no data is publicly available to back up this assertion.

[2]: 3 SWFs invest in a variety of asset classes such as stocks, bonds, real estate, private equity and hedge funds.

Since its creation in 1956, when the British administration of the Gilbert Islands in Micronesia put a levy on the export of phosphates used in fertilizer, the fund has grown to $520 million.

Governments may be able to spend the money immediately, but risk causing the economy to overheat, e.g., in Hugo Chávez's Venezuela or Shah-era Iran.

The Government of Singapore Investment Corporation, Temasek Holdings, or Mubadala are partially the expression of a desire to bolster their countries' standing as an international financial centre.

[2]: 9 SLFs help facilitate a state's ability to use its selective equity investments to promote its industrial policies and strategic interests.

[2]: 9 The growth of sovereign wealth funds is attracting close attention because: The governments of SWFs commit to follow certain rules: A number of transparency indices sprang up before the Santiago Principles, some more stringent than others.

[20] Natural resource-rich developing economies are typically encouraged to adopt good governance standards for sovereign wealth funds, such as the Santiago Principles, which emphasize transparency, accountability, and sound investment practices.

[23] Non-commodity SWFs are typically funded by transfer of assets from official foreign exchange reserves, and in some cases from government budget surpluses and privatization revenues.

The most notable ones have been Algeria's FRR, Brazil's FSB, Ecuador's numerous SWF arrangements, Papua New Guinea's MRSF, and Venezuela's FIEM and FONDEN.

The main reason why these funds have been exhausted is due to political instability, while economic determinants generally play a less important role.

[citation needed] Highly stable countries, such as Denmark, Qatar, China, or Australia are less likely to experience SWF depletion precisely because of their political stability.

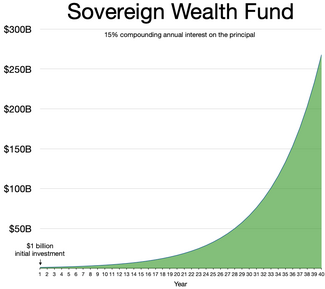

15% compounding interest annually

$26.7 billion in total dividend payments over 40 years.

Dividends were not reinvested and can be used as revenue for the government.