Sri Lankan economic crisis (2019–2024)

[9] It has led to unprecedented levels of inflation, near-depletion of foreign exchange reserves, shortages of medical supplies, and an increase in prices of basic commodities.

[22] The Institute of Policy Studies of Sri Lanka's 2014 State of the Economy Report highlighted hot money, worrying borrowing practices, temporary and superficial quick-fixes and monopoly of foreign direct investment flow into the hospitality sector.

Then Central Bank Governor, Indrajit Coomaraswamy, noted Balance of Payments issues, increased inflation, and asset bubbles as reasons for the ban.

Both nations had similar issues, including deep economic crises occurring after their successive governments piled up unsustainable debts following the end of civil wars (Lebanese and Sri Lankan respectively).

[31] To reduce the inflation and control the economy crisis in April 2022, Dr. P. Nandalal Weerasinghe was appointed as the 17th Governor of the Central Bank of Sri Lanka (CBSL) to replace Ajith Nivard Cabraal.

[43][44] In 2020, US economist Joseph Eugene Stiglitz, published a report that blamed the quantitative easing policy made by US banks after 2008, for exporting debt bubbles to developing countries including Sri Lanka.

[49] In September 2021, the government announced an economic emergency, as the situation was further aggravated by the falling national currency exchange rate, inflation rising as result of high food prices, and pandemic restrictions in tourism which further decreased the country's income.

[64] Colombo had originally arranged a bailout from the IMF, but decided to raise the required funds by leasing the under-performing Hambantota Port to an experienced company as the Canadian feasibility study had recommended.

[76] In January 2022, President Gotabhaya Rajapaksa's office stated that it would appeal to China to reschedule its debt burden during talks with the Chinese foreign minister Wang Yi.

[97] Both Dr Anurudha Padeniya, President of the GMOA, and Gotabaya Rajapaksa have associated the use of chemical fertilizer with chronic kidney disease, but scientific research has blamed the high mineral content of local water, including fluoride and magnesium, combined with the hot climate.

[100][101][102] In November 2021, following weeks of protests over rising food prices, Sri Lanka abandoned its plan to become the world's first organic farming nation.

[101] On 29 May 2022, the government forecasted that the Yala season harvest would fall to 50% of normal, and that it would be unable to provide fertilizer to raise the yield, while rice stocks in the country would only last until September.

Finance Minister Basil Rajapaksa urged all government authorities to switch off all street lights at least up until the end of March 2022 in an attempt to conserve electricity.

[78][141] The term test examinations were stated to be held island-wide on 28 March 2022, but due to the acute shortage of printing paper and ink ribbons, a decision was made to either cancel or postpone the exams to a later date.

[154] Following the worsening economic as well as political conditions in Sri Lanka, India has also witnessed a sharp surge in overseas orders for tea products.

[180] On 7 April an expert presidential advisory group consisting of Indrajit Coomaraswamy, Shanta Devarajan, Sharmini Cooray was formed by the President to assist with the situation including proceedings with the IMF.

[181][182] The bailout talks got underway on 18 April 2022 in Washington with Ali Sabry on behalf of the government urged immediate emergency financial help through a loan package.

[190] After the violent protests on 9 July which resulted in the resignation announcements of President Rajapaksa and Prime Minister Wickremesinghe, IMF said that it is hoping for a resolution to Sri Lanka's political turmoil that will allow a resumption of talks for a bailout package.

[192] On 7 April 2022, the Chamber of Young Lankan Entrepreneurs (COYLE) had also made an appeal to the government to solve the current economic and political crisis and had warned that if the issue had not been addressed with due diligence it could lead to closure of businesses.

He also insisted that there are no other options except to seek assistance from multilateral agencies to cope with the crisis and especially called on the government to restructure the US$1 billion ISB bond repayment which matures around July 2022.

[194] On 8 April 2022, former World Bank official Shanta Devarajan warned that the biggest risk Sri Lanka is going to face is social unrest and turmoil.

He highlighted that a cash transfer program can be initiated aiming at helping the poor people in addition to the reduction in subsidies on food and fuel to avoid the collapse of the economy.

[195] Moody's Investors Service had warned that the wave of the resignation of cabinet ministers would only heighten policy uncertainty and as a result, it will make hard when obtaining or borrowing external finance.

[citation needed] In January 2022, India pledged a total of US$2.415 billion to overcome dire financial constraints caused by external debt payments and a lack of US dollars in Sri Lanka for business.

[220] On 17 March 2022, Sri Lanka received a $1 billion credit line as a lifeline from India in order to buy urgently needed essential items such as food and medicine.

2.4 trillion, inflation would continue to rise, daily power outages could increase up to 15 hours a day, medicine shortage has become severe, especially for heart disease and surgical equipment.

An 'agreement in principle' was reached between Sri Lanka, India, and the Paris Club of creditors, including Japan, aligning debt treatment parameters with the IMF's Extended Fund Facility arrangement.

[264] This positive outlook followed four consecutive quarters of growth driven by the industrial and tourism sectors, supported by critical structural and policy reforms.

[citation needed] The International Monetary Fund (IMF) also acknowledged Sri Lanka's progress, approving the third review of the country's $2.9 billion bailout in November 2024.

The IMF noted that signs of economic recovery were emerging, although it cautioned that the economy remained vulnerable and emphasized the need for continued reforms and debt restructuring.

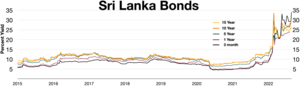

In early March 2022 the Sri Lankan Rupee began losing value quickly

Inverted yield curve in the first half of 2022