Government budget

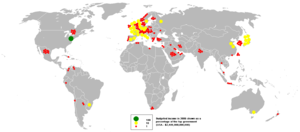

[1] Credible budgets, which are defined as statutory fixed term (generally one year) budgets auditable by parliament, were first introduced in the Netherlands in 1572, England in 1689, France in 1830, Denmark, Piedmont, and Prussia in 1848, Portugal in 1851, Sweden in 1866, Austria in 1867, and Spain in 1876.

[2][1] The practice of presenting budgets and fiscal policy to parliament was initiated by Sir Robert Walpole in his position as Chancellor of the Exchequer in an attempt to restore the confidence of the public after the chaos unleashed by the collapse of the South Sea Bubble in 1720.

[3] Thirteen years later, Walpole announced his fiscal plans to bring in an excise tax on the consumption of a variety of goods and services, such as wine and tobacco, and to lessen the taxation burden on the landed gentry.

Concerning the duties on wine and tobacco - the first time the word 'budget' was used in connection with the government's fiscal policies.

As the productive forces of capitalism developed, the economic power of the bourgeoisie gradually grew, and the political demands for democracy became more and more vocal.

After the triumph of the bourgeois revolution in 1640, England, as a parliamentary monarchy, had all of its financial powers controlled by Parliament.

[7] The emergence of the capitalist mode of production and the high level of development of the commodity economy led to an expansion of the state's financial resources and a massive increase in both revenue and expenditure.

From the West, the emergence of the capitalist mode of production and the gradual economic power of the bourgeoisie led to increasing demands for political rights.

The bourgeoisie demanded the complete separation of the state from the home and the control of government revenues and expenditures through parliament.

Based on this principle, the bourgeoisie united with the workers in a long struggle against the feudal aristocracy, which was finally compromised.

In essence, the budget is a mechanism by which the taxpayers and their representative bodies control the financial activities of the government, a distribution of public power between different subjects as a means of allocating resources, a structure of checks and balances and a democratic political process.

The taxpayers, who have the right to independent assets, are responsible for the financial provision of the State, which necessarily requires control of the State's finances and a legal procedure to ensure that government revenues and expenditures do not deviate from the interests of the taxpayers.

ZBB involves building the budget from the ground up each fiscal year, starting from a "zero base," and justifying every expense.

Government budgets also have a political basis wherein different interests push and pull in an attempt to obtain benefits and avoid burdens.

Top-down approach: The central financial authority (e.g. the Ministry of finance) sets boundaries to the budget and the government completes it.

[15] A simple examination of expenditures does not do justice to the complex relationships between the federal government and the states and localities.

In some cases, the federal government pays[16] for a program and gives broad discretion to the states as to how to carry out the mandate.

In other cases, the federal government essentially dictates all the terms, and the states simply administer the program.