Temporary Assistance for Needy Families

TANF funds may be used for the following reasons: to provide assistance to needy families so that children can be cared for at home; to end the dependence of needy parents on government benefits by promoting job preparation, work and marriage; to prevent and reduce the incidence of out-of-wedlock pregnancies; and to encourage the formation and maintenance of two-parent families.

[4] Prior to TANF, Aid to Families with Dependent Children was a major federal assistance program that was coming under heavy criticism.

Beginning with President Ronald Reagan's administration and continuing through the first few years of the Clinton administration, growing dissatisfaction with AFDC, particularly the rise in welfare caseloads, led an increasing number of states to seek waivers from AFDC rules to allow states to more stringently enforce work requirements for welfare recipients.

[7] However, the findings that welfare-to-work programs did have some effect in reducing dependence on government increased support among policymakers for moving welfare recipients into employment.

[8] While liberals and conservatives agreed on the importance of transitioning families from government assistance to jobs, they disagreed on how to accomplish this goal.

More specifically, conservatives wanted to impose a five-year lifetime limit on welfare benefits and provide block grants for states to fund programs for poor families.

[9] Conservatives argued that welfare to work reform would be beneficial by creating role models out of mothers, promoting maternal self-esteem and sense of control, and introducing productive daily routines into family life.

Furthermore, they argued that reforms would eliminate welfare dependence by sending a powerful message to teens and young women to postpone childbearing.

Liberals responded that the reform sought by conservatives would overwhelm severely stressed parents, deepen the poverty of many families, and force young children into unsafe and unstimulating child care situations.

In addition, they asserted that welfare reform would reduce parents' ability to monitor the behaviors of their children, leading to problems in child and adolescent functioning.

He advocated providing assistance to families for a limited time, after which recipients would be required to earn wages from a regular job or a work opportunity program.

[8] Low wages would be supplemented by expanded tax credits, access to subsidized childcare and health insurance, and guaranteed child support.

PRWORA replaced AFDC with TANF and dramatically changed the way the federal government and states determine eligibility and provide aid for needy families.

In general, states must use funds to serve families with children, with the only exceptions related to efforts to reduce non-marital childbearing and promote marriage.

Under AFDC, states provided cash assistance to families with children, and the federal government paid half or more of all program costs.

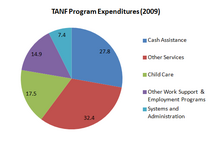

They spend the rest of the funding on other types of services, including programs not aimed at improving employment opportunities for poor families.

[22] In July 2012, the Department of Health and Human Services released a memo notifying states that they are able to apply for a waiver for the work requirements of the TANF program.

The number of caseloads was lower in 2000 than at any time since 1969, and the percentages of persons receiving public assistance income (less than 3%) was the lowest on record.

[32] While the participation of many low-income single parents in the labor market has increased, their earnings and wages remained low, and their employment was concentrated in low-wage occupations and industries: 78 percent of employed low-income single parents were concentrated in four typically low-wage occupations: service; administrative support and clerical; operators, fabricators, and laborers; and sales and related jobs.

[6] However, due to the fact that low-income mothers who left welfare are likely to be concentrated in low-wage occupations, the decline in public assistance caseloads has not translated easily into reduction in poverty.

[30][35] TANF requirements have led to massive drops in the number of people receiving cash benefits since 1996,[36] but there has been little change in the national poverty rate during this time.

A major impetus for welfare reform was concern about increases in out-of-wedlock births and declining marriage rates, especially among low-income women.

[6] Studies have produced only modest or inconsistent evidence that marital and cohabitation decisions are influenced by welfare program policies.

TANF allowed states to impose family caps on the receipt of additional cash benefits from unwed childbearing.

Opponents, on the other hand, argued that requiring women to work at low pay puts additional stress on mothers, reduces the quality time spent with children, and diverts income to work-related expenses such as transportation and childcare.

[47] Another study found large and significant effects of welfare reform on educational achievement and aspirations, and on social behavior (i.e. teacher assessment of compliance and self-control, competence and sensitivity).

The positive effects were largely due to the quality of childcare arrangement and afterschool programs that accompanied the move from welfare to work for these recipients.

[58] The third category listed, subsidized employment, made national headlines[59] as states created nearly 250,000 adult and youth jobs through the funding.

However, Congress did not work on legislation to reauthorize the program and instead they extended the TANF block grant through September 30, 2011, as part of the Claims Resolution Act.

[65] It has been shown that TANF-exiting working women who use and maintain the transitional incentive services described above are less likely to return to receiving assistance and are more likely to experience long term employment.