Tax protester Sixteenth Amendment arguments

Proper ratification of the Sixteenth Amendment is disputed by tax protesters who argue that the quoted text of the Amendment differed from the text proposed by Congress, or that Ohio was not a State during ratification, despite its admission to the Union on March 1, 1803,[2] more than a century prior.

Sixteenth Amendment ratification arguments have been rejected in every court case where they have been raised and have been identified as legally frivolous.

Others argue that due to language in Stanton v. Baltic Mining Co., the income tax is an unconstitutional direct tax that should be apportioned (divided amongst various states according to their respective population), despite the court ruling in Stanton that "the provisions of the Sixteenth Amendment conferred no new power of taxation" and that income taxation is a "previous complete and plenary power... possessed by Congress from the beginning".

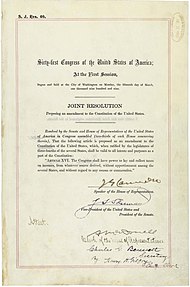

Many tax protesters contend that the Sixteenth Amendment to the United States Constitution was never properly ratified (see, e.g., Devvy Kidd).

In Scott, the defendant – who called himself a "national tax resistance leader" – had been convicted of willful failure to file federal income tax returns for the years 1969 through 1972, and the conviction was upheld by the United States Court of Appeals for the Ninth Circuit.

[8] In the 1977 case of Ex parte Tammen, the United States District Court for the Northern District of Texas noted testimony in the case to the effect that taxpayer Bob Tammen had become involved with a group called "United Tax Action Patriots", a group that took the position "that the Sixteenth Amendment was improperly passed and therefore invalid".

The specific issue of the validity of the ratification of the Amendment was neither presented to nor decided by the court in the Tammen case.

The William J. Benson contention claims procedural issues in the ratification process, violations of state law, and that the legislatures of various states passed ratifying resolutions in which the quoted text of the Amendment differed from the text proposed by Congress in terms of capitalization, spelling of words, or punctuation marks (e.g. semi-colons instead of commas), and that these differences made the ratification invalid.

Benson also contended that in Oklahoma, the legislature changed the wording of the amendment so that its meaning was virtually the opposite of what was intended by Congress, and that this was the version they sent back to Knox.

Benson alleged that Knox counted Oklahoma as having approved it, despite a memo from his chief legal counsel, Reuben Clark, that states were not allowed to change the proposal in any way.

The Benson contention was comprehensively addressed by the Seventh Circuit Court of Appeals in United States v. Thomas:[12] Thomas is a tax protester, and one of his arguments is that he did not need to file tax returns because the sixteenth amendment is not part of the constitution.

1986), we relied on Leser, as well as the inconsequential nature of the objections in the face of the 73-year acceptance of the effectiveness of the sixteenth amendment, to reject a claim similar to Thomas's.

[14] On December 17, 2007, the United States District Court for the Northern District of Illinois ruled that Benson's non-ratification argument constituted a "fraud perpetrated by Benson" that had "caused needless confusion and a waste of the customers' and the IRS' time and resources".

[15] The court stated: "Benson has failed to point to evidence that would create a genuinely disputed fact regarding whether the Sixteenth Amendment was properly ratified or whether United States Citizens are legally obligated to pay federal taxes.

"[16] The court ruled that "Benson's position has no merit and he has used his fraudulent tax advice to deceive other citizens and profit from it" in violation of 26 U.S.C. § 6700.

[29] Another argument made by some tax protesters is that because the United States Congress did not pass an official proclamation (Pub.

As the legislative history of this Act makes clear, its purpose was to settle a burning debate as to the precise date upon which Ohio became one of the United States.

[36]The argument that the Sixteenth Amendment was not ratified and variations of this argument have been officially identified as legally frivolous federal tax return positions for purposes of the $5,000 frivolous tax return penalty imposed under Internal Revenue Code section 6702(a).

[38] The resolution regarding this admission signed by President Dwight D. Eisenhower in 1953 recognizes March 1, 1803, as the date of Ohio's admittance into the Union.

If this argument were correct, then the losing presidential candidate would be the vice-president of the United States, because the 12th Amendment did not expressly repeal Article II, Section 1, clause 3 of the Constitution.

And Senators would still be selected by state legislatures, because the 17th Amendment did not expressly repeal any part of Article I, section 3, of the Constitution.

[44]In Buchbinder v. Commissioner, the taxpayers cited the case of Eisner v. Macomber and argued that "the Sixteenth Amendment must be interpreted so as not to 'repeal or modify' the original Articles of the Constitution".

"[46] The actual statement by the United States Supreme Court in Eisner v. Macomber is that the Sixteenth Amendment "shall not be extended by loose construction, so as to repeal or modify, except as applied to income, those provisions of the Constitution that require an apportionment according to population for direct taxes upon property, real and personal ...

In order, therefore, that the clauses cited from Article I of the Constitution may have proper force and effect, save only as modified by the Amendment ... it becomes essential to distinguish between what is and what is not 'income'.

"[47] In Parker v. Commissioner, tax protester Alton M. Parker, Sr.,[48] challenged the levying of tax upon individual income, based on language in the U.S. Supreme Court decision in Stanton v. Baltic Mining Co.,[49] to the effect that the Sixteenth Amendment "conferred no new power of taxation, but simply prohibited the previous complete and plenary power of income taxation possessed by Congress from the beginning from being taken out of the category of indirect taxation to which it inherently belonged".

(Compare Ratio decidendi, Precedent, Stare decisis and Obiter dictum for a fuller explanation.)

The Court noted that the case "was commenced by the appellant [John R. Stanton] as a stockholder of the Baltic Mining Company, the appellee, to enjoin [i.e., prevent] the voluntary payment by the corporation and its officers of the tax assessed against it under the income tax section of the tariff act of October 3, 1913".

According to the Congressional Research Service at the Library of Congress, a total of forty-two states have ratified the amendment.

[56] Tax lawyer Alan O. Dixler wrote: Each year some misguided souls refuse to pay their federal income tax liability on the theory that the 16th Amendment was never properly ratified, or on the theory that the 16th Amendment lacks an enabling clause.

If, strictly for the purposes of this discussion, the 16th Amendment could be disregarded, the taxpayers making those frivolous claims would still be subject to the income tax.