Tax return

[3] A person or organization may not be required to file a tax return depending on circumstances, which are different in each country.

Many governments utilize electronic filling and payment systems that keep a record of a person's history of tax returns and refunds.

Another notable change in recent years is that government bodies share the data with each other.

[7] The length of the completion of a tax return depends on the country, but the world average is almost 232 hours.

Income consists of the sources of a citizen's revenue, excluding items which are exempt from tax by law.

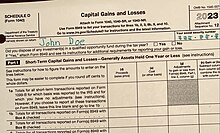

Wages, salaries, income from retirement plans, dividends, interest and capital gains or losses should be considered as a source of revenue.

Deductions are items that are subtracted from taxable income, thereby reducing the tax liability.

It is a tool that reports and provides information about the additional calculations and other amounts stated in the tax return.