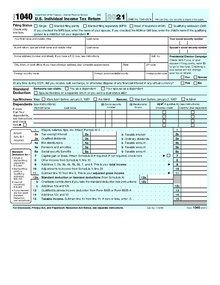

Form 1040

The form calculates the total taxable income of the taxpayer and determines how much is to be paid to or refunded by the government.

The second page reports income, calculates the allowable deductions and credits, figures the tax due given adjusted income, and applies funds already withheld from wages or estimated payments made towards tax liability.

On the right side of the first page is the presidential election campaign fund checkoff, which allows individuals to designate that the federal government give $3 of the tax it receives to the presidential election campaign fund.

Resident aliens of the United States for tax purposes must generally file if their income crosses a threshold where their taxable income is likely to be positive, but there are many other cases where it may be legally desirable to file.

Form 1040, along with its variants, schedules, and instructions, can be downloaded as PDFs from the Internal Revenue Service website.

Paper forms can be filled and saved electronically using a compatible PDF reader, and then printed.

This way, it is easy to keep electronic copies of one's filled forms despite filing by paper.

The paper Form 1040, along with all relevant schedules and additional forms, must be sent in a single packet by mail or courier to an IRS address determined by the US state the taxpayer is filing from and whether or not a payment is enclosed.

Furthermore, the available existing electronic filing options may not offer sufficient flexibility with respect to arranging one's tax return, adding attachments, or putting written notes of explanation that can help preempt IRS questions.

In the past, filing electronically may have exposed the taxpayer's data to the risk of accidental loss or identity theft,[17][18] but now e-filing with reputable companies is considered more secure than paper filing.

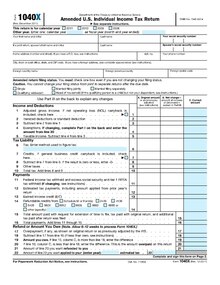

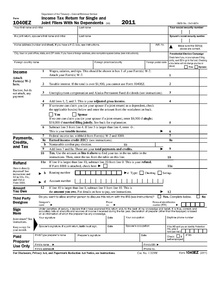

[23][24][25] For filing the regular tax return, in addition to the standard Form 1040, there are currently three variants: the 1040-NR 1040-SR, and 1040-X.

For 2009 and 2010 there was an additional form, Schedule M, due to the "Making Work Pay" provision of the American Recovery and Reinvestment Act of 2009 ("the stimulus").

In addition to the listed schedules, there are dozens of other forms that may be required when filing a personal income tax return.

Typically these will provide additional details for deductions taken or income earned that are listed either on form 1040 or its subsequent schedules.

In 2014 there were two additions to Form 1040 due to the implementation of the Affordable Care Act—the premium tax credit and the individual mandate.

[42][43] Employer withholding is also treated differently from estimated tax payment, in that for the latter, the time of the year when the payment was made matters, whereas for the former, all that matters is how much has been withheld as of the end of the year (though there are other restrictions on how one can adjust one's withholding pattern that need to be enforced by the employer).

Tax protesters contend that Form 1040 does not contain an "OMB Control Number" which is issued by the U.S. Office of Management and Budget under the Paperwork Reduction Act.

Individual Income Tax Return has contained the OMB Control number since 1981.

Cases involving the OMB Control Number Argument include: The United States Court of Appeals for the Sixth Circuit argues that the provisions on the Paperwork Reduction Act are not relevant as the act applies only to information requests made after December 31, 1981, and tax returns starting from 1981 contained an OMB Control Number.

[54] The United States Court of Appeals for the Seventh Circuit rejected the convicted taxpayer's OMB control number argument by stating "Finally, we have no doubt that the IRS has complied with the Paperwork Reduction Act.

The United States Court of Appeals for the Seventh Circuit rejected the OMB argument stating that According to Lawrence, the Paperwork Reduction Act of 1995 (PRA) required the Internal Revenue Service to display valid Office of Management and Budget (OMB) numbers on its Form 1040.... Lawrence argues that the PRA by its terms prohibits the government from imposing a criminal penalty upon a citizen for the failure to complete a form where the information request at issue does not comply with the PRA...

In contrast, the government referenced numerous cases supporting its position that the PRA does not present a defense to a criminal action for failure to file income taxes.

[65] Initially, the IRS mailed tax booklets (Form 1040, instructions, and most common attachments) to all households.

As alternative delivery methods (CPA/Attorneys, Internet forms) increased in popularity, the IRS sent fewer packets via mail.

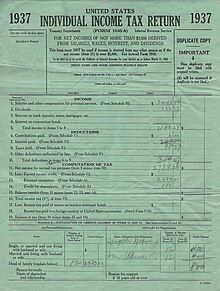

This was changed to March 15 in the Revenue Act of 1918, and in the Internal Revenue Code of 1954, the tax return deadline was changed to April 15 from March 15,[66] as part of a large-scale overhaul of the tax code.

Quartz created an animated GIF showing the gradual changes to the structure and complexity of the form.

[74] The NTU table is below with data through 2014: The number of pages in the federal tax law grew from 400 in 1913 to over 72,000 in 2011.

[72] As an example, whereas the initial versions of Form 1040 came only with a rate schedule included in the tax form itself, the IRS now publishes a complete tax table for taxable income up to $100,000 so that people can directly look up their tax liability from their taxable income without having to do complicated arithmetic calculations based on the rate schedule.

[78] As of 2013, there were more tax preparers in the US (1.2 million) than there were law enforcement officers (765 thousand) and firefighters (310,400) combined.

[75] The National Taxpayers Union estimated the 2018 compliance cost at 11 hours per form 1040 vs. 12 hours in 2017, with a total of $92.5 billion spent in individual income tax compliance vs. $94.27 billion in 2017.