Progressive tax

[13][14][15] One study suggests progressive taxation is positively associated with subjective well-being, while overall tax rates and government spending are not.

For Roman citizens, the tax rate under normal circumstances was 1% of property value, and could sometimes climb as high as 3% in situations such as war.

These taxes were levied against land, homes and other real estate, slaves, animals, personal items and monetary wealth.

By 167 BC, Rome no longer needed to levy a tax against its citizens in the Italian peninsula, due to the riches acquired from conquered provinces.

The first modern income tax was introduced in Great Britain by Prime Minister William Pitt the Younger in his budget of December 1798, to pay for weapons and equipment for the French Revolutionary War.

Peel, as a Conservative, had opposed income tax in the 1841 general election, but a growing budget deficit required a new source of funds.

Despite the vociferous objection, William Gladstone, Chancellor of the Exchequer from 1852, kept the progressive income tax, and extended it to cover the costs of the Crimean War.

The Sixteenth Amendment to the United States Constitution, adopted in 1913, permitted Congress to levy all income taxes without any apportionment requirement.

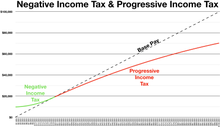

[21] The idea of Negative Income Tax (NIT) was stumbled upon and discussed by various thinkers and is most commonly attributed to Milton Friedman, who made it more prominent in his 1962 work ‘Capitalism and Freedom’.

[22] NIT is a system where the flow of the tax payment is inverted for salaries falling a specified threshold; Individuals surpassing the given level have to contribute money to the state, while those below are recipients of said funds.

The adjustability of subsidies given to the poor households by the system eliminates the welfare trap issue faced by other proposals (i.e. means-test).

[23] A survey conducted in 1995 established that the majority of American economists advocated for the addition of a negative income tax into the welfare system.

[12][28] When income inequality is low, aggregate demand will be relatively high, because more people who want ordinary consumer goods and services will be able to afford them, while the labor force will not be as relatively monopolized by the wealthy.

[29][30] High levels of income inequality can have negative effects on long-term economic growth, employment, and class conflict.

[33] The economists Thomas Piketty and Emmanuel Saez wrote that decreased progressiveness in US tax policy in the post World War II era has increased income inequality by enabling the wealthy greater access to capital.

[13] According to economist Robert H. Frank, tax cuts for the wealthy are largely spent on positional goods such as larger houses and more expensive cars.

Frank argues that these funds could instead pay for things like improving public education and conducting medical research,[34] and suggests progressive taxation as an instrument for attacking positional externalities.

[35] A report published by the OECD in 2008 presented empirical research showing a weak negative relationship between the progressivity of personal income taxes and economic growth.

[47] Theoretically, public support for government spending on higher education increases when taxation is progressive, especially when income distribution is unequal.

[48] Friedrich Hayek viewed the implementation of progressive tax systems as incompatible with the principles of an open and liberal society.

Progressive tax prohibits the incentives of free market competition, whilst the wealth is subordinated to the democratic vote of a majority.

Hayek believed the sweeping rise of progressive tax has risen from deceptive justifications which in reality didn't bring fruit.

This is because the current tax system charges the individual based on wages and not investment income, an area where the upper-class make most of their money.

Prominent investor Warren Buffett has been a strong voice in support of taxing the rich proportional to investment income as well as wages.

"[55] A 2011 study psychologists Shigehiro Oishi, Ulrich Schimmack, and Ed Diener, using data from 54 countries, found that progressive taxation was positively associated with the subjective well-being, while overall tax rates and government spending were not.

[56] Since progressive taxation reduces the income of high earners and is often used as a method to fund government social programs for low income earners, calls for increasing tax progressivity have sometimes been labeled as envy or class warfare,[clarification needed][35][57][58] while others may describe such actions as fair or a form of social justice.

Their research findings concluded that voters hold the belief that all citizens should be treated equally with regards to taxation regardless of the income that they bring in.

This perspective emphasizes equal-treatment fairness norms, which suggest that all citizens should be treated equally in areas such as voting rights and legal protections.

While progressive tax policies may address income inequality in certain countries, there is a significant segment of the population that opposes them based on this notion of political equality.

The net effect is increased progressivity that completely limits deductions for state and local taxes and certain other credits for individuals earning more than $306,300.