Terra Securities scandal

This utilization of the loophole was confirmed by the Norwegian Ministry of Local Government and Regional Development in 2002, because the money borrowed was secured in future income.

Vik had borrowed 70 million kr through DnB Markets based on annual payments of NOK 10M, secured through income from hydroelectric power production.

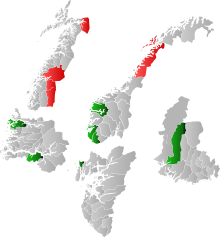

[2] In the same year, in 2001, the four Nordland municipalities of Narvik, Rana, Hemnes, and Hattfjelldal borrowed money to invest in complicated bonds issued by Citigroup and sold through Terra Securities.

The other three municipalities had ownership in HelgelandsKraft (Rana 26.8%, Hemnes 7.0% and Hattfjelldal 2.5%) as well as property tax income from power stations owned by Statkraft.

The Financial Supervisory Authority of Norway announced that they would perform an investigation of the case, regarding the legality of the products sold and the information provided by Terra.

[6] Minister of Local Government and Regional Development Magnhild Meltveit Kleppa asked the County Governor of Nordland to investigate whether the agreements made were legal according to the Municipality Act.

[7] Terra-Gruppen started an internal investigation, but has since only relocated the two advisors, claiming that top management could not be held responsible for any issues in connection with the products.

On 26 November 2007, Terra announced that they were willing to take the downside of the investments made in 2007 by the four Nordland municipalities, a total loss of 150 million kr.

On 28 November 2007, the Financial Supervisory Authority of Norway announced that they would withdraw all operating licenses held by Terra Securities.

Director of the authority, Bjørn Skogstad Aamo said the reasons were "numerous and serious breaches of requirements for good and correct information to clients".

Due to the bankruptcy of Terra Securities, Citigroup announced, on 30 November 2007, that they would sell the funds on the open market, essentially inflicting a cost of approximately 350 million kr on the municipalities.

Terra Securities ASA filed for bankruptcy on 28 November 2007, the day after they received a letter from the Financial Supervisory Authority of Norway announcing the withdrawal of permissions to operate.