Transaction cost

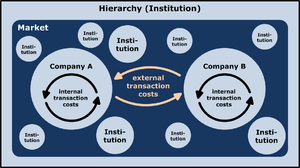

[3] Douglass C. North argues that institutions, understood as the set of rules in a society, are key in the determination of transaction costs.

[6] According to Williamson, the determinants of transaction costs are frequency, specificity, uncertainty, limited rationality, and opportunistic behavior.

Douglass North states that there are four factors that comprise transaction costs – "measurement", "enforcement", "ideological attitudes and perceptions", and "the size of the market".

[11] The idea that transactions form the basis of an economic theory was introduced by the institutional economist John R. Commons in 1931.

The outcome, in either case, was the materialistic metaphor of an automatic equilibrium, analogous to the waves of the ocean, but personified as "seeking their level".

Transactions intervene between the labor of the classic economists and the pleasures of the hedonic economists, simply because it is society that controls access to the forces of nature, and transactions are, not the "exchange of commodities", but the alienation and acquisition, between individuals, of the rights of property and liberty created by society, which must therefore be negotiated between the parties concerned before labor can produce, or consumers can consume, or commodities be physically exchanged".The term "transaction cost" is frequently and mistakenly thought to have been coined by Ronald Coase, who used it to develop a theoretical framework for predicting when certain economic tasks would be performed by firms, and when they would be performed on the market.

Often this involves considering as "transactions" not only the obvious cases of buying and selling, but also day-to-day emotional interactions and informal gift exchanges.

To avoid these potential costs, "hostages" may be swapped, which may involve partial ownership in the widget factory and revenue sharing.

An example of measurement, one of North's four factors of transaction costs, occurs when roving bandits calculate the success of their banditry based on how much money they can take from their citizens.

It has been shown that the presence of transaction costs as modelled by Anderlini and Felli can overturn central insights of the Grossman-Hart-Moore theory of the firm.

[23][24] Oliver E. Williamson's[25] theory of evaluative mechanisms assess economic entitles based on eight variables: bounded rationality, atmosphere, small numbers, information asymmetric, frequency of exchange, asset specificity, uncertainty, and threat of opportunism.