Petroleum in the United States

The industry is often informally divided into "upstream" (exploration and production), "midstream" (transportation and refining), and "downstream" (distribution and marketing).

An independent is a company which has all or almost all of its operations in a limited segment of the industry, such as exploration and production, refining, or marketing.

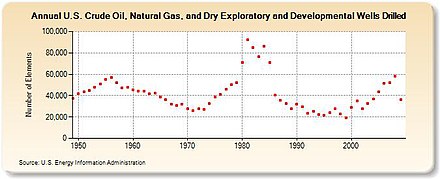

Exploratory drilling, seismic and other remote sensing techniques are used to explore for and find new hydrocarbon resources.

Since oil is historically the higher value product, the gas may be viewed as a waste by-product when such plans are delayed, fail, or do not exist.

[10] In the U.S., a growing volume and percentage of the produced associated gas is intentionally wasted in this way since about year 2000, reaching nearly 50-year highs of 500 billion cubic feet and 7.5% in 2018.

[13] The product extracted at the wellhead, usually a mixture of oil/condensate, gas, and water, goes through equipment on the lease to separate the three components.

The oil and produced water are in most cases stored in separate tanks at the site, and periodically removed by truck.

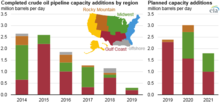

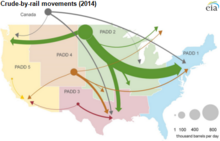

Crude oil and petroleum products are transported mainly by pipelines, rail, or water via tanker ships.

If the refinery is not close, the tanker truck will take the crude oil to a pipeline, barge, or railroad for long-distance transport.

In February 2015, railroads supplied 52 percent of all crude oil delivered to US refineries on the East Coast.

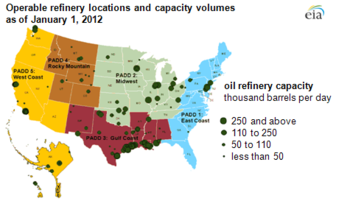

[17] The United States petroleum refining industry, the world's largest, is most heavily concentrated along the Gulf Coast of Texas and Louisiana.

[20] Refined petroleum products destined for retail consumption is transferred to bulk terminals by pipeline, barge, or rail.

As of February 2014, there were 153,000 service stations selling motor fuel in the US, including garages, truck stops, convenience stores, and marinas.

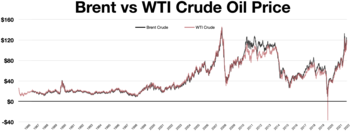

In the 1950s, there were strikes by oil workers, production restrictions imposed by the Texas Railroad Commission, as well as the Suez Crisis and Korean War—all creating steep price increases, with prices only falling after production could meet demand.

Additional singular events such as the OPEC embargo, the rupture of the Trans-Arabian Pipeline, and Iranian Nationalization of the oil industry resulted in further never-before-seen price increases.

[28] Oil futures dropped on 5 August 2024, due to U.S. recession fears and concerns about Chinese demand, with Brent and WTI falling over 1%.

OPEC+ plans to increase supply added pressure, while geopolitical risks in the Middle East limited further losses.

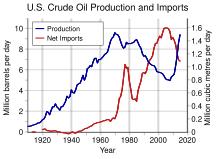

[29] In the twentieth century, oil production became of more value, as the US industrialized and developed commercial transportation, such as railroads and motor vehicles.

However, U.S. oil domestic production could not cover the growing demand in the nation's market, which allowed the U.S. to look for a new supply internationally.

During the Great Depression, both growing supply and falling demand caused the price of oil to decrease to about 66% between 1926 and 1931.

[30] Toward the end of World War II, the automotive era settled rapidly, and the nation's demand of oil increased 12% between 1945 and 1947 while motor vehicle registrations did so by 22%.

Policies affect the market in several ways, such as price, production, consumption, supply and demand.

The oil market has had a history of booms and troughs, which have caused producers to demand government intervention.

These import quotas restricted international oil companies from the US market, and allowed them to form the OPEC.

[34] During his administration, in response to an energy crisis and hostile Iranian and Soviet Union relations, President Carter announced the Carter Doctrine, which declared that any interference with the nation's interests in the Persian Gulf would be considered an attack on its vital interests.

[34] Near the end of 2015 President Barack Obama signed a spending bill lifting a four decade ban on exports of crude oil.

[37] On March 24, 2017, the Trump administration issued a presidential permit to allow construction of the Keystone XL pipeline.

[38] On August 17, 2020, the Trump administration opened the Arctic National Wildlife Refuge to oil exploitation.

[39] In 2021, President Joe Biden rejoined the Paris Agreement and closed the Arctic National Wildlife Refuge to oil exploitation.

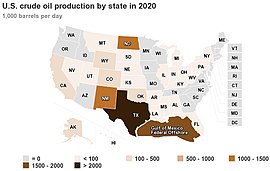

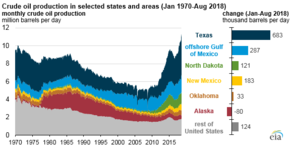

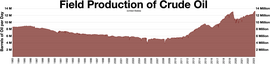

2018 production was 10.99 million barrels (1,747,000 m3) per day of crude oil (not including natural gas liquids).

in barrels of oil a day (average for the month)