Unemployment in the United States

[20] On May 8, 2020, the Bureau of Labor Statistics reported that 20.5 million nonfarm jobs were lost and the unemployment rate rose to 14.7 percent in April, due to the Coronavirus pandemic in the United States.

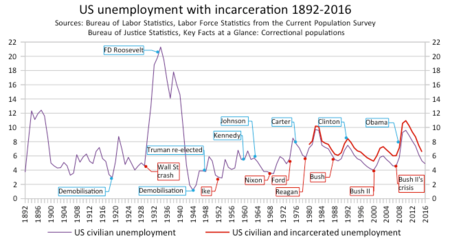

Using this method, the five Presidents with the most job gains (in millions) were: Bill Clinton 22.745; Ronald Reagan 16.322; Barack Obama 12.503; Lyndon B. Johnson 12.338; and Jimmy Carter 10.117.

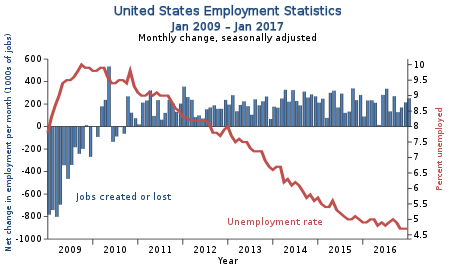

However, measures of labor force participation (even among the prime working age group), and the share of long-term unemployed were worse than pre-crisis levels.

[71][72] Research indicates recovery from financial crises can be protracted relative to typical recessions, with lengthy periods of high unemployment and substandard economic growth.

[79] Mothers were likely to suffer from unemployment for several reasons, including daycare closures, household structures, and job flexibility based on gender.

"[123] As part of the economic policy of Barack Obama, the United States Congress funded approximately $800 billion in spending and tax cuts via the February 2009 American Recovery and Reinvestment Act to stimulate the economy.

The Fed expanded its balance sheet significantly from 2008 to 2014, meaning it essentially "printed money" to purchase large quantities of mortgage-backed securities and U.S. treasury bonds.

Typical proposals involve stimulus spending on infrastructure construction, clean energy investment, unemployment compensation, educational loan assistance, and retraining programs.

A September 2012 survey by The Economist found those earning over $100,000 annually were twice as likely to name the budget deficit as the most important issue in deciding how they would vote than middle- or lower-income respondents.

[130] A March 2011 Gallup poll reported: "One in four Americans say the best way to create more jobs in the U.S. is to keep manufacturing in this country and stop sending work overseas.

Americans also suggest creating jobs by increasing infrastructure work, lowering taxes, helping small businesses, and reducing government regulation."

Republicans next highest ranked items were lowering taxes and reducing regulation, while Democrats preferred infrastructure stimulus and more help for small businesses.

An October 2010 Wall Street Journal/NBC News poll reported that: "[M]ore than half of those surveyed, 53%, said free-trade agreements have hurt the U.S. That is up from 46% three years ago and 32% in 1999."

Across party lines, income, and job type, 76–95% of Americans surveyed agreed that "outsourcing of production and manufacturing work to foreign countries is a reason the U.S. economy is struggling and more people aren't being hired".

"[132] The debate around the American Recovery and Reinvestment Act of 2009 (ARRA), the approximately $800 billion stimulus bill that was passed in response to the subprime mortgage crisis, highlighted these views.

Senator Dick Durbin proposed a bill in 2010 called the "Creating American Jobs and Ending Offshoring Act" that would have reduced tax advantages from relocating U.S. plants abroad and limited the ability to defer profits earned overseas.

"[138] During 2012, there was significant debate regarding approximately $560 billion in tax increases and spending cuts scheduled to go into effect in 2013, which would reduce the 2013 budget deficit roughly in half.

[139] The Congressional Budget Office projected that such sharp deficit reduction would likely cause the U.S. to enter recession in 2013, with the unemployment rate rising to 9% versus approximately 8% in 2012, costing over 1 million jobs.

Economic theory suggests that (other things equal) tax cuts are a form of stimulus (they increase the budget deficit)[140] and therefore create jobs, much like spending.

[141][142] The historical record indicates that marginal income tax rate changes have little impact on job creation, economic growth or employment.

[154] Authors Bittle & Johnson of Public agenda explained the pros and cons of 14 job creation arguments frequently discussed, several of which are summarized below by topic.

[159] President Obama reduced the Social Security payroll tax on workers during the 2011–2012 period, which added an estimated $100 billion to the deficit while leaving these funds with consumers to spend.

Regulations that would add costs to petroleum and coal may slow the economy, although they would provide incentives for clean energy investment by addressing regulatory uncertainty regarding the price of carbon.

[168] The CBO reported in February 2014 that increasing the minimum wage to $10.10 per hour between 2014 and 2016 would reduce employment by an estimated 500,000 jobs, while about 16.5 million workers would have higher pay.

Inc. magazine published 16 ideas to encourage new startups, including cutting red tape, approving micro-loans, allowing more immigration, and addressing tax uncertainty.

Providing loans contingent on degrees focused on fields with worker shortages such as healthcare and accounting would address structural workforce imbalances (i.e., a skills mismatch).

[155] Federal Reserve Chair Janet Yellen stated in 2014: "Public funding of education is another way that governments can help offset the advantages some households have in resources available for children.

Research shows that children from lower-income households who get good-quality pre-Kindergarten education are more likely to graduate from high school and attend college as well as hold a job and have higher earnings, and they are less likely to be incarcerated or receive public assistance.

"[190] Reuters reported a figure of 250,000 in February 2013, stating sustained job creation at this level would be needed to "significantly reduce the ranks of unemployed.

[198] CBO estimated in December 2015 that the Patient Protection and Affordable Care Act (also known colloquially as "Obamacare") would reduce the labor supply by approximately 2 million full-time worker equivalents (measured as a combination of persons and hours worked) by 2025, relative to a baseline without the law.