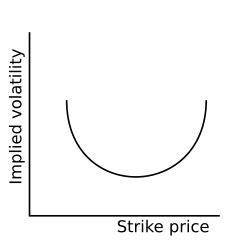

Volatility smile

Graphing implied volatilities against strike prices for a given expiry produces a skewed "smile" instead of the expected flat surface.

This anomaly implies deficiencies in the standard Black–Scholes option pricing model which assumes constant volatility and log-normal distributions of underlying asset returns.

In the Black–Scholes model, the theoretical value of a vanilla option is a monotonic increasing function of the volatility of the underlying asset.

This implied volatility is best regarded as a rescaling of option prices which makes comparisons between different strikes, expirations, and underlyings easier and more intuitive.

However, the implied volatilities of options on foreign exchange contracts tend to rise in both the downside and upside directions.

In equity markets, a small tilted smile is often observed near the money as a kink in the general downward sloping implicit volatility graph.

For instance, it is well-observed that realized volatility for stock prices rises significantly on the day that a company reports its earnings.

Correspondingly, we see that implied volatility for options will rise during the period prior to the earnings announcement, and then fall again as soon as the stock price absorbs the new information.

For instance, options on commodity futures typically show increased implied volatility just prior to the announcement of harvest forecasts.

Options on US Treasury Bill futures show increased implied volatility just prior to meetings of the Federal Reserve Board (when changes in short-term interest rates are announced).

For instance, the impact of upcoming results of a drug trial can cause implied volatility swings for pharmaceutical stocks.