Butterfly (options)

In finance, a butterfly (or simply fly) is a limited risk, non-directional options strategy that is designed to have a high probability of earning a limited profit when the future volatility of the underlying asset is expected to be lower (when long the butterfly) or less lower (when short the butterfly) than that asset's current implied volatility.

Using put–call parity a long butterfly can also be created as follows: where X = the spot price and a > 0.

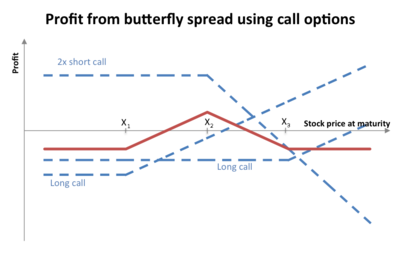

At expiration the value (but not the profit) of the butterfly will be: The maximum value occurs at X (see diagram).

In the United States, margin requirements for all options positions, including a butterfly, are governed by what is known as Regulation T. However brokers are permitted to apply more stringent margin requirements than the regulations.

This implied distribution may be different from the lognormal distribution assumed in the popular Black-Scholes model, and studying it can reveal ways in which real-world assets differ from the idealized assets described by Black-Scholes.