Wall Street

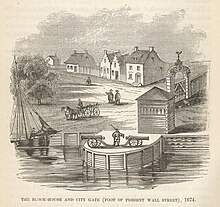

[3] The original wall was constructed under orders from Director General of the Dutch West India Company, Peter Stuyvesant, at the start of the first Anglo-Dutch war soon after New Amsterdam was incorporated in 1653.

"[10] The first Anglo-Dutch War ended in 1654 without hostilities in New Amsterdam, but over time the "werken" (meaning the works or city fortifications) were reinforced and expanded to protect against potential incursions from Native Americans, pirates, and the English.

[16] In these early days, local merchants and traders would gather at disparate spots to buy and sell shares and bonds, and over time divided themselves into two classes—auctioneers and dealers.

[17] In 1789, Wall Street was the scene of the United States' first presidential inauguration when George Washington took the oath of office on the balcony of Federal Hall on April 30, 1789.

Alexander Hamilton, who was the first Treasury secretary and "architect of the early United States financial system", is buried in the cemetery of Trinity Church, as is Robert Fulton, famed for his steamboats.

[22] The opening of the Erie Canal in the early 19th century meant a huge boom in business for New York City, since it was the only major eastern seaport which had direct access by inland waterways to ports on the Great Lakes.

[18] Historian Charles R. Geisst suggested that there has constantly been a "tug-of-war" between business interests on Wall Street and authorities in Washington, D.C., the capital of the United States by then.

The stock market crash of 1929 ushered in the Great Depression, in which a quarter of working people were unemployed, with soup kitchens, mass foreclosures of farms, and falling prices.

[36] In 1975, the SEC threw out the NYSE's "Rule 394" which had required that "most stock transactions take place on the Big Board's floor", in effect freeing up trading for electronic methods.

A report in The New York Times described that the flushness of money and growth during these years had spawned a drug culture of sorts, with a rampant acceptance of cocaine use although the overall percent of actual users was most likely small.

Stylishly dressed and wearing designer sunglasses, she sat in her 1983 Chevrolet Camaro in a no-parking zone across the street from the Marine Midland Bank branch on lower Broadway.

But as the dealer slipped him a heat-sealed plastic envelope of cocaine and he passed her cash, the transaction was being watched through the sunroof of her car by Federal drug agents in a nearby building.

And the customer — an undercover agent himself -was learning the ways, the wiles and the conventions of Wall Street's drug subculture.In 1987, the stock market plunged,[18] and, in the relatively brief recession following, the surrounding area lost 100,000 jobs according to one estimate.

[43] To guard against a vehicular bombing in the area, authorities built concrete barriers, and found ways over time to make them more aesthetically appealing by spending $5000 to $8000 apiece on bollards.

Cars, however, cannot pass.The Guardian reporter Andrew Clark described the years of 2006 to 2010 as "tumultuous", in which the heartland of America was "mired in gloom" with high unemployment around 9.6%, with average house prices falling from $230,000 in 2006 to $183,000, and foreboding increases in the national debt to $13.4 trillion, but that despite the setbacks, the American economy was once more "bouncing back".

Foolishly and recklessly, the banks didn't look at these loans adequately, relying on flawed credit-rating agencies such as Standard & Poor's and Moody's, which blithely certified toxic mortgage-backed securities as solid ... A few of those on Wall Street, including maverick hedge fund manager John Paulson and the top brass at Goldman Sachs, spotted what was going on and ruthlessly gambled on a crash.

Most, though, got burned – the banks are still gradually running down portfolios of non-core loans worth $800bn.The first months of 2008 was a particularly troublesome period which caused Federal Reserve chairman Ben Bernanke to "work holidays and weekends" and which did an "extraordinary series of moves".

[45] A report by Michael Stoler in The New York Sun described a "phoenix-like resurrection" of the area, with residential, commercial, retail and hotels booming in the "third largest business district in the country".

[70] City authorities realize its importance, and believed that it has "outgrown its neoclassical temple at the corner of Wall and Broad streets", and in 1998, offered substantial tax incentives to try to keep it in the Financial District.

[41] Wall Street pay, in terms of salaries and bonuses and taxes, is an important part of the economy of New York City, the tri-state metropolitan area, and the United States.

[78] The seven largest Wall Street firms in the 2000s were Bear Stearns, JPMorgan Chase, Citigroup, Goldman Sachs, Morgan Stanley, Merrill Lynch and Lehman Brothers.

[79] But as technology progressed, in the middle and later decades of the 20th century, computers and telecommunications replaced paper notifications, meaning that the close proximity requirement could be bypassed in more situations.

[18] So-called "face-to-face" trading between buyers and sellers remains a "cornerstone" of the NYSE, with a benefit of having all of a deal's players close at hand, including investment bankers, lawyers, and accountants.

Since the end of the cold war, vast pools of capital have been forming overseas, in the Swiss bank accounts of Russian oligarchs, in the Shanghai vaults of Chinese manufacturing magnates and in the coffers of funds controlled by governments in Singapore, Russia, Dubai, Qatar and Saudi Arabia that may amount to some $2.5 trillion.An example is the alternative trading platform known as BATS, based in Kansas City, which came "out of nowhere to gain a 9 percent share in the market for trading United States stocks".

To Americans, it can sometimes represent elitism and power politics, and its role has been a source of controversy throughout the nation's history, particularly beginning around the Gilded Age period in the late 19th century.

The 1987 Oliver Stone film Wall Street created the iconic figure of Gordon Gekko who used the phrase "greed is good", which caught on in the cultural parlance.

[101] Gekko is reportedly based on multiple real-life individuals on Wall Street, including corporate raider Carl Icahn, disgraced stock trader Ivan Boesky, and investor Michael Ovitz.

"[101] Wall Street firms have, however, also contributed to projects such as Habitat for Humanity, as well as done food programs in Haiti, trauma centers in Sudan, and rescue boats during floods in Bangladesh.

[103] Many people associated with Wall Street have become famous; although in most cases their reputations are limited to members of the stock brokerage and banking communities, others have gained national and international fame.

For some, like hedge fund manager Ray Dalio,[109] their fame is due to skillful investment strategies, financing, reporting, legal or regulatory activities, while others such as Ivan Boesky, Michael Milken and Bernie Madoff are remembered for their notable failures or scandal.