War finance

The power of a military depends on its economic base and without this financial support, soldiers will not be paid, weapons and equipment cannot be manufactured and food cannot be bought.

[1] War finance measures can be broadly classified into three main categories: Thus these measures may include levy of specific taxation, increase and enlarging the scope of existing taxation, raising of compulsory and voluntary loans from the public, arranging loans from foreign sovereign states or financial institutions, and also the creation of money by the government or the central banking authority.

The brutal wars between the Roman empire and the Carthaginians proved to be very costly so much that Rome even ran out of money altogether at one stage.

As a consequence, raising taxes on a tax-averse population in order to fund a war might result in widespread anti-war sentiment.

[3] The British government felt that they were an exception to this general rule and they saw their wealth and financial stability as one of their strongest warfighting assets.

It turned out however that it came at an extraordinary financial expense and as such thought it was best to pay for it by borrowing money and could thus transfer the war costs to future generations.

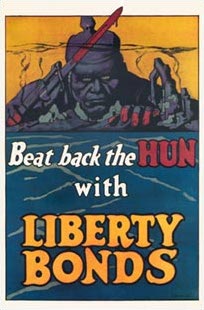

The United States government during World War 1 spent over $300 million which converts to over $4 billion in today's financial market.

The advertisement of these bonds were carried out through many media outlets and through propaganda materials on radio, cinema adverts and newspapers in order to convince the large multitude of the countries population.

[6] The government can also use a monetary tool to finance war, it could print more money in order to pay for troops, military complex and arms.

Much of the extra money supply was absorbed by the war loans fortunate for the western countries while rationing out the controlled prices.

When a conflict leads to higher governmental expenditures, the population financing the war is either paying directly (and immediately) or indirectly (and maybe delayed).

The former comprises taxes through which the population bears directly the burden, the latter includes borrowing or increasing the money supply.

Empirical studies have established a connection between a leader's tax policy and subsequent punitive electoral consequences as they represent a permanent transfer of purchasing power by the taxpayer to the government.

The advantage of borrowing is that it likely transfers the financial burden to a future government and consequently does not affect the current leader's prospects of a potential re-election.

That means because borrowing affects people only indirectly and is an accepted measure in general, it makes war a more diffuse target for critics, because it will be just one of the government's numerous debt sources.

With the business sector being its main political base, the Republicans opposed higher income taxes, rather favouring less fiscal policy, including on war taxation.