2021–2023 inflation surge

It has been attributed to various causes, including pandemic-related economic dislocation, supply chain disruptions, the fiscal and monetary stimulus provided in 2020 and 2021 by governments and central banks around the world in response to the pandemic, and price gouging.

[14] In countries where food constituted a large part of the inflation increase, rising prices forced low-income consumers to reduce spending on other goods, thereby slowing economic growth.

In 2023, the International Monetary Fund ascertained that "food and energy are the main drivers of this inflation", as rising prices continue to squeeze living standards not only in North America but worldwide.

[24] The higher demand caused by the U.S. government's $5 trillion aid spending exacerbated supply-side issues in the United States; according to the Federal Reserve Bank of San Francisco researchers, this contributed 3 percentage points to inflation by the end of 2021.

[citation needed] In June 2022, BlackRock CEO Larry Fink argued that consumer demand in the United States had remained steady compared to pre-pandemic years, with supply-chain issues overseas being the primary cause of the post-pandemic inflation surge.

[33] Among the factors contributing to the surge of inflation were the unprecedented levels of fiscal and monetary stimulus enacted to sustain household incomes and the liquidity of financial institutions in the 2020–2021 period.

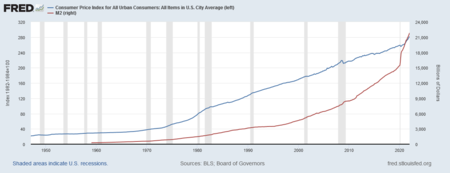

Fed chairman Jerome Powell said in December 2021 that the once-strong link between the money supply and inflation "ended about 40 years ago," due to financial innovations and deregulation.

[68] European Central Bank economists found in May 2023 that businesses were using the surge as a rare opportunity to boost their profit margins, finding it was a bigger factor than rising wages in fueling inflation during the second half of 2022.

[71] An International Monetary Fund study published in June 2023 found that rising corporate profits accounted for almost half of the increase in euro area inflation during the preceding two years.

[72] A December 2023 paper published by the UK-based Institute for Public Policy Research and Common Wealth think tanks stated that corporate profiteering played an important role in the inflation spike of 2022.

Corporate profits surged while wages failed to keep pace with rising prices, resulting in the working class suffering the largest decline in disposable and discretionary income since World War II.

[80] In July, the UK imposed a 25% windfall profit tax on British North Sea oil producers, which expected to raise £5 billion to pay for a government scheme that reduced household energy costs.

[85] An analysis published in early 2024 by the White House Council of Economic Advisers found that grocery and beverage retailers had increased their margins by nearly two percentage points since the eve of the pandemic, to the highest level in two decades.

President Joe Biden and others asserted that shrinkflation, a practice of reducing portion or quantity sizes of packaged foods while maintaining the same price, was keeping profit margins higher than usual.

[86][87][88] The Federal Trade Commission released a report in March 2024 finding that large grocery retailers "accelerated and distorted" the effects of supply chain disruptions to protect their profits.

[68] The FTC and several state attorneys general in February 2024 sued to block a proposed $25 billion merger between large grocery chains Kroger and Albertsons, arguing the deal would reduce competition and likely lead to higher consumer prices.

[101][102][103][104] Mark Zandi, chief economist of Moody's Analytics, analyzed United States Consumer Price Index components following the May 2022 report that showed an 8.6% inflation rate in the U.S.

[108] On February 22, 2022, before the Russian invasion, the German Government froze the Nord Stream 2 pipeline between Russia and Germany,[109] causing natural gas prices to rise significantly.

Food producers of Nestlé's Middle East and North Africa (MENA) unit have noticed the stock-piling of non-perishable items, as a reaction to the surging inflation.

[141][142] Nevertheless, the hikes were seen as faster and sooner than the response by the European Central Bank, so while the euro fell, the dollar remained relatively strong, helping it to be the more valuable currency for the first time in 20 years.

[156] Inflation is believed to have played a major role in a decline in the approval rating of President Joe Biden, who took office in January 2021, being net negative starting in October of that year.

[158] In March 2023, Federal Reserve chairman Jerome Powell said that currently the primary drivers of inflation are supply chain problems, consumers' change to purchases of goods rather than services, and the tight labor market.

Analysis conducted by NerdWallet on October 2023 data found that prices for 92 of the 338 goods and services measured in CPI had declined from one year earlier, representing deflation for those items.

As the Federal Reserve sharply increased the fed funds rate to combat the inflation surge, the longest and deepest Treasury inverted yield curve in history began in July 2022.

No recession had materialized by July 2024, economic growth remained steady, and a Reuters survey of economists that month found they expected the economy to continue growing for the next two years.

There is a consensus among economists that Chilean inflation is mainly caused by endogenous factors, especially the aggressive expansionary policies during the COVID-19 pandemic and the massive withdrawals from pension funds.

[204] In the UK, inflation reached a 40-year high of 10.1% in July 2022, driven by food prices, and further increase is anticipated in October when higher energy bills are expected to hit.

[216][217] In June 2022, the European Central Bank (ECB) decided to raise interest rates for the first time in eleven years due to the elevated inflation pressure.

[218][219] In July, the euro fell below the U.S. dollar for the first time in 20 years, mainly due to fears of energy supply restrictions from Russia, but also because the ECB lagged behind the US, UK and other central banks in raising interest rates.

This included Japan, where the Liberal Democratic Party (LDP), who have governed the country nearly continuously since 1955, suffered its worst loss since 2009, as voters grappled with rising housing costs and inflation.

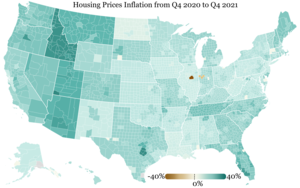

40%

20%

0%

-20%

-40%