Recession

[22] The European Union, akin to the NBER's methodology, has embraced a definition of recession that integrates GDP alongside a spectrum of macroeconomic indicators, including employment and various other metrics.

Recessions in the United Kingdom are generally defined as two consecutive quarters of negative economic growth, as measured by the seasonal adjusted quarter-on-quarter figures for real GDP.

By examining these factors comprehensively, economists gain insights into the complex dynamics that contribute to economic downturns and can formulate effective strategies for mitigating their impact (Anderson, 2019; Patel, 2017).

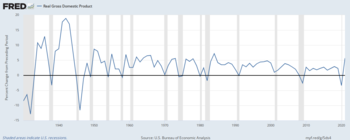

In the US, v-shaped, or short-and-sharp contractions followed by rapid and sustained recovery, occurred in 1954 and 1990–1991; U-shaped (prolonged slump) in 1974–1975, and W-shaped, or double-dip recessions in 1949 and 1980–1982.

Korea, Hong Kong and South-east Asia experienced U-shaped recessions in 1997–1998, although Thailand's eight consecutive quarters of decline should be termed L-shaped.

[34] Excessive levels of indebtedness or the bursting of a real estate or financial asset price bubble can cause what is called a "balance sheet recession".

Economist Paul Krugman wrote in 2014 that "the best working hypothesis seems to be that the financial crisis was only one manifestation of a broader problem of excessive debt—that it was a so-called "balance sheet recession".

It was triggered by a collapse in land and stock prices, which caused Japanese firms to have negative equity, meaning their assets were worth less than their liabilities.

Koo argues that it was massive fiscal stimulus (borrowing and spending by the government) that offset this decline and enabled Japan to maintain its level of GDP.

In a balance sheet recession, GDP declines by the amount of debt repayment and un-borrowed individual savings, leaving government stimulus spending as the primary remedy.

[38][39] A July 2012 survey of balance sheet recession research reported that consumer demand and employment are affected by household leverage levels.

A liquidity trap is a Keynesian theory that a situation can develop in which interest rates reach near zero (zero interest-rate policy) yet do not effectively stimulate the economy.

However, if too many individuals or corporations focus on saving or paying down debt rather than spending, lower interest rates have less effect on investment and consumption behavior; increasing the money supply is like "pushing on a string".

Economist Hyman Minsky also described a "paradox of deleveraging" as financial institutions that have too much leverage (debt relative to equity) cannot all de-leverage simultaneously without significant declines in the value of their assets.

[45] In April 2009, U.S. Federal Reserve Vice Chair Janet Yellen discussed these paradoxes: "Once this massive credit crunch hit, it didn't take long before we were in a recession.

While these factors can individually contribute to a recession, the cumulative impact of several occurring simultaneously can significantly amplify the negative effect on the economy.

[52] The longest and deepest Treasury yield curve inversion in history began in July 2022, as the Federal Reserve sharply increased the fed funds rate to combat the 2021–2023 inflation surge.

An earlier survey of bond market strategists found a majority no longer believed an inverted curve to be a reliable recession predictor.

[53][54][55] The following variables and indicators are used by economists, like e.g. Paul Krugman or Joseph Stiglitz, to try to predict the possibility of a recession: Except for the above, there are no known completely reliable predictors.

[153] Gauti B. Eggertsson of the Federal Reserve Bank of New York, using a New Keynesian macroeconomic model for policy analysis, writes that cutting taxes on labor or capital is contractionary under certain circumstances, such as those that prevailed following the economic crisis of 2008, and that temporarily increasing government spending at such times has much larger effects than under normal conditions.

Further, while capital tax cuts are inconsequential in his model with a positive interest rate, they become strongly negative at zero, and the multiplier of government spending is then almost five times larger.

[162] For example, the 1981 recession is thought to have been caused by the tight-money policy adopted by Paul Volcker, chairman of the Federal Reserve Board, before Ronald Reagan took office.

In other words, unemployment never reaches 0%, so it is not a negative indicator of the health of an economy, unless it exceeds the "natural rate", in which case the excess corresponds directly to a loss in the GDP.

Recessions have also provided opportunities for anti-competitive mergers, with a negative impact on the wider economy; the suspension of competition policy in the United States in the 1930s may have extended the Great Depression.

[167] In April 2009, IMF had changed their Global recession definition to "A decline in annual per‑capita real World GDP (purchasing power parity weighted), backed up by a decline or worsening for one or more of the seven other global macroeconomic indicators: Industrial production, trade, capital flows, oil consumption, unemployment rate, per‑capita investment, and per‑capita consumption.

Although the collapse was larger than the one in 1929, the global economy recovered quickly, but North America still suffered a decline in lumbering savings and loans, which led to a crisis.

Australia next went into recession in March 2020, due to the impact of huge bush fires and the COVID-19 pandemic's effect on tourism and other important aspects of the economy.

In 1947, NBER did not declare a recession despite two quarters of declining GDP, due to strong economic activity reported for employment, industrial production, and consumer spending.

[195] Although the US economy grew in the first quarter by 1%,[196][197] by June 2008 some analysts stated that due to a protracted credit crisis and "rampant inflation in commodities such as oil, food, and steel", the country was nonetheless in a recession.

[200] A November 2008 report from the Federal Reserve Bank of Philadelphia based on the survey of 51 forecasters, suggested that the recession started in April 2008 and would last 14 months.