2022 Russian crude oil price cap sanctions

As part of the sanctions imposed on the Russian Federation as a result of the Russo-Ukrainian War, on September 2, 2022, finance ministers of the G7 group of nations agreed to cap the price of Russian oil and petroleum products in an effort intended to reduce Russia's ability to finance its war on Ukraine while at the same time hoping to curb further increases to the 2021–2022 inflation surge.

Flow of Russian oil through pipelines has been exempted from the price capping on which land locked countries like Hungary is mostly dependent on for supply.

By May 2023 the G7 countries considered the sanctions had been successful in achieving oil supply stability and reducing Russian tax revenue.

[11] Some energy analysts expressed skepticism that a price cap would be realistic because the coalition is "not broad enough"; OPEC+ called the plan "absurd".

[29] The Kremlin issued a presidential decree that prohibits Russian companies and any traders from selling oil to anyone that participates in a price cap.

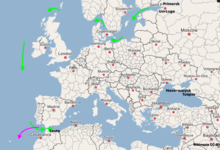

[32] An experiment in sending one of its three ice-breaking oil tankers to China, sailing through the arctic circle north of Russia, has been tested, the journey is 3,300 miles and will take around 8 weeks.

The RF exported Urals crude, a type of commodity that undergoes particular dynamics controlled by Russia, and as these discounts are gradually reduced, income flows to Russia will increase again, "contributing to the gradual recovery of tax revenues from the oil sector, especially in the second half of 2023," according to TASS, quoting the Ministry of Finance.

[42] Ukrainian president Volodymyr Zelenskyy called the oil cap "a weak position" and not "serious" enough to damage to the Russian economy.

[76] ¶ Production data suppressed by Russia until April 2024 ◇ Export duty ceased in December 2023, replaced by a mineral extraction tax (MET.)

[85] Port of Novorossiysk and Tuapse oil terminal maritime locations on the Black Sea[86] were likely the source for ship-to-ship transfers in the Greek Bay of Lakonikos.

[88] In the east of the country, the Port of Kozmino is the terminus of the Eastern Siberia-Pacific Ocean pipeline; Rosneft, Gazpromneft and Surgutneftegas use it to funnel their product through intermediaries to China.

[89] The Gulf of Lakonikos is a favourite transfer point because it is sheltered and Greek territorial waters extend only to six nautical miles from the shoreline.

[90][91] Around 55 percent of the tankers that transport Russian oil out of the country were Greek-owned, they can continue operating provided the price cap conditions are met.

[18] In December the percentage of Greek-owned ships moving Russian oil fell to 33% with the gap being filled by shadow fleet tankers.

[92] Cyprus reported that in two months from the beginning of October 2022, around 20% (900,000 gross tonnes) of their flagged oil tanker fleet have departed, by changing their registry.

Concern over safety has resulted in Singapore holding 33 oil and chemical tankers that have failed inspections in the last year, more than in a normal decade, many of the ships are older, "shadow fleet" ones.

EU parties may not deal with any vessel that within the previous 90 days had discharged Russian oil at a price over the cap level.

[104] On 22 November 2022 the Office of Foreign Assets Control (OFAC) in the USA published guidance on the operation of the Price Cap Policy.

[118] 60% of Russian oil transported in December was in tankers controlled by UAE, China, India and Russia, twice previous levels.

Consequences of maritime incidences from oil tankers would pose a significant risk to oceans and shoreline communities across the world, according to the statement.

[135] OFAC issued an alert regarding possible sanction breaking with tankers using eastern ports turning off their Automatic Identification Systems (AIS).

[146] The Monitoring Group of the Black Sea Institute of Strategic Studies reported that three tankers, the LIPARI, the SEMBRANI and the GUANYIN likely broke sanctions in August by transhipping 377,766 tons of Russian crude oil in the Laconian Gulf off the coast of Greece.

Russia was aware that any sanctions against their country would result in a need to control tankers to export crude and processed oil.

[164] in January 2024 the 18 year old sanctioned Peria had an anchor malfunction, leaving the ship stranded in the Bosphorus, closing all traffic.

[171] ◆ In mid December NS Century, whose original destination was Vadinar in India, was still waiting off Sri Lanka and had been joined by two other crude tankers owned by Sovocomflot.

[172] Reportedly Russia does not want to be paid in rupee's, preferring UAE dirham's, however Sakhalin 1 LLC has been unable to open a bank account.

[178] The economic cost to Russia of losing the European market is huge, both in redundant pipelines and facilities and in lost future revenue.

[124] Early projections by the EU estimated that the price cap on Russian oil would cost Russia around 160m euros ($175m) every day ($60b pa).

Many nations such as India and China had been purchasing Russian oil at a discount set by Russia, and the current price increase triggered by a renewed OPEC+ cut were seen as critical factors that could undermine the sanctions regime implemented by the E.U.

This indicates a reduced sale price per barrel which has impacted heavily on the Russian tax take on crude oil.