Aggregate demand

[1] It is often called effective demand, though at other times this term is distinguished.

It specifies the amount of goods and services that will be purchased at all possible price levels.

[2] Consumer spending, investment, corporate and government expenditure, and net exports make up the aggregate demand.

The Keynes effect states that a higher price level implies a lower real money supply and therefore higher interest rates resulting from relevant market equilibrium condition, in turn resulting in lower investment spending on new physical capital and hence a lower quantity of goods being demanded in the aggregate.

Aggregate demand is expressed contingent upon a fixed level of the nominal money supply.

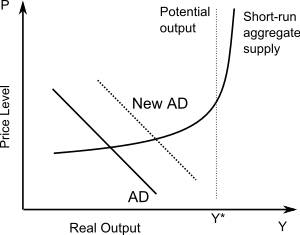

Rightward shifts result from increases in the money supply, in government expenditure, or in autonomous components of investment or consumption spending, or from decreases in taxes.

[5] John Maynard Keynes in The General Theory of Employment, Interest and Money argued during the Great Depression that the loss of output by the private sector as a result of a systemic shock (the Wall Street crash of 1929) ought to be filled by government spending.

First, he argued that with a lower 'effective aggregate demand', or the total amount of spending in the economy (lowered in the Crash), the private sector could subsist on a permanently reduced level of activity and involuntary unemployment, unless there were active intervention.

People with lower incomes are inclined to spend their earnings immediately to buy housing, food, transport and so forth, while people with much higher incomes cannot consume everything.

Spending should therefore target public works programmes on a large enough scale to speed up growth to its previous levels.

in real or inflation-corrected terms) at any given aggregate average price level (such as the GDP deflator),

The main theoretical reason for this is that if the nominal money supply (Ms) is constant, a falling

)rises, encouraging lower interest rates and higher spending.

But different levels of economic activity imply different mixtures of output and price increases.

As shown, with very low levels of real gross domestic product and thus large amounts of unemployed resources, most economists of the Keynesian school suggest that most of the change would be in the form of output and employment increases.

curve will shift to the left, making the increases in real output transitory.

First, most modern industrial economies experience few if any fall in prices.

Second, when they do suffer price cuts (as in Japan), it can lead to disastrous deflation.

If debt grows or shrinks slowly as a percentage of GDP, its impact on aggregate demand is small.

Since write-offs and savings rates both spike in recessions, both of which result in shrinkage of credit, the resulting drop in aggregate demand can worsen and perpetuate the recession in a vicious cycle.

This perspective originates in, and is intimately tied to, the debt-deflation theory of Irving Fisher, and the notion of a credit bubble (credit being the flip side of debt), and has been elaborated in the Post-Keynesian school.

[7] If the overall level of debt is rising each year, then aggregate demand exceeds Income by that amount.

This causes a sudden and sustained drop in aggregate demand, and this shock is argued to be the proximate cause of a class of economic crises, properly financial crises.

Indeed, a fall in the level of debt is not necessary – even a slowing in the rate of debt growth causes a drop in aggregate demand (relative to the higher borrowing year).

[9] These crises then end when credit starts growing again, either because most or all debts have been repaid or written off, or for other reasons as below.

Austrian theorist Henry Hazlitt argued that aggregate demand is "a meaningless concept" in economic analysis.

[10] Friedrich Hayek, another Austrian, wrote that Keynes' study of the aggregate relations in an economy is "fallacious", arguing that recessions are caused by micro-economic factors.