Early 1980s recession

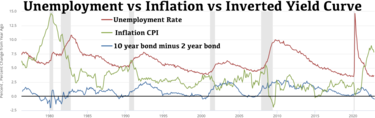

[3][4][5] The recession had multiple causes including the tightening of monetary policies by the United States and other developed nations.

[3] This was exacerbated by the 1979 energy crisis, mostly caused by the Iranian Revolution which saw oil prices rising sharply in 1979 and early 1980.

[3] The sharp rise in oil prices pushed the already high rates of inflation in several major advanced countries to new double-digit highs, with countries such as the United States, Canada, West Germany, Italy, the United Kingdom, and Japan tightening their monetary policies by increasing interest rates in order to control the inflation.

[12] The Bank of Canada raised its prime interest rate throughout 1980 and early 1981 in an attempt to rein in inflation, with the deeper second portion of the recession beginning in July 1981.

[11] Canada's GDP increased markedly in November 1982 officially ending the recession, although employment growth did not resume until December 1982,[9] before faltering again in 1983.

[10] The lingering effects of the recession combined with mechanization and companies downsizing to complete internationally, kept Canada's unemployment rates above 10% until 1986.

[18] Thatcher set about controlling inflation with monetarist policies and changing trade union legislation in an attempt to reduce the strikes of public-sector workers.

[19] Thatcher's battle against inflation raised the exchange rate, resulting in the closure of many factories, shipyards and coal pits because imports were cheaper and the strong pound made British products more expensive in export markets.

[21] In Significance, Grahame Allen wrote: "The UK's lack of export competitiveness and widening trade deficit is a cause for concern today, but it is far from historically unusual.

"[22] Areas of Tyneside, Yorkshire, Merseyside, South Wales, Western Scotland and the West Midlands were hit hard by the loss of industry and subsequent sharp rise in unemployment.

[23] Despite the economic recovery that followed the early 1980s recession, unemployment in the United Kingdom barely fell until the second half of the decade.

[26] The mass unemployment and social discontent resulting from the recession were widely seen as major factors in the 1981 England riots in parts of towns and cities including Toxteth, Liverpool, as well as a number of districts of London.

By the end of 1989, it was just over 1.6 million, almost half the figure of three years earlier;[29] however, the unemployment figures did not include benefit claimants who were placed on Employment Training schemes, an adult variant of the controversial Youth Training Scheme, who were paid the same rate of benefit for working full-time hours.

[38] The peak of the recession occurred in November and December 1982, when the nationwide unemployment rate was 10.8%, the highest since the Great Depression.

When Reagan was re-elected in 1984, the latest unemployment numbers (August 1984) showed that West Virginia still had the highest rate in the nation (13.6%) followed by Mississippi (11.1%) and Alabama (10.9%).

Several key industries, including housing, steel manufacturing, and automobiles, experienced a downturn from which they did not recover until the end of the next recession.

The Depository Institutions Deregulation and Monetary Control Act of 1980 had phased out a number of restrictions on their financial practices, broadened their lending powers, and raised the deposit insurance limit from $40,000 to $100,000, which caused moral hazard.

[46] By the end of the year, the Federal Deposit Insurance Corporation (FDIC) had spent $870 million to purchase bad loans in an effort to keep various banks afloat.

The Act authorized banks to begin offering money market accounts in an attempt to encourage deposit in-flows, and it also removed additional statutory restrictions in real estate lending and relaxed loans-to-one-borrower limits.

However, federal regulators were reassured by Continental Illinois executives that steps were being taken to ensure the bank's financial security.

In 1980, there were approximately 4590 state and federally chartered savings and loan institutions (S&Ls), with total assets of $616 billion.

Until the 1980s, savings and loans had limited lending powers and so the FHLBB was a relatively small agency, overseeing a quiet, stable industry.

Also, the FHLBB was unable to add to its staff because of stringent limits on the number of personnel that it could hire and the level of compensation it could offer.

One consequence of the FHLBB's lack of enforcement abilities was the promotion of deregulation and of aggressive, expanded lending to forestall insolvency.

Germain Act expanded the authority of federally chartered S&Ls to make acquisition, development, and construction real estate loans, and the statutory limit on loan-to-value ratios was eliminated.

Beginning in 1982, many S&Ls rapidly shifted away from traditional home mortgage financing and into new, high-risk investment activities like casinos, fast-food franchises, ski resorts, junk bonds, arbitrage schemes, and derivative instruments.

In some cases, state-chartered S&Ls had close political ties to elected officials and state regulators, which further weakened oversight.

The CCEA pushed the FHLBB to refrain from re-regulating the S&L industry and adamantly opposed any governmental expenditures to resolve the S&L problem.

[55] The recession,[56][57][58] coupled with budget cuts, which were enacted in 1981 but began to take effect only in 1982, led many voters to believe that Reagan was insensitive to the needs of average citizens and favored the wealthy.

[62] According to Keynesian economists, a combination of deficit spending and the lowering of interest rates would slowly lead to economic recovery.

Percent change from preceding period in real GDP (annualized; seasonally adjusted) Average GDP growth 1947–2009

Source: Bureau of Economic Analysis