Early 2000s recession

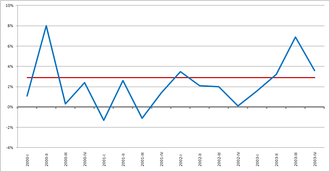

The early 2000s recession was a major decline in economic activity which mainly occurred in developed countries.

[1] The UK, Canada and Australia avoided the recession, while Russia, a nation that did not experience prosperity during the 1990s, began to recover from it.

Some economists in the United States object to characterizing it as a recession since there were no two consecutive quarters of negative growth.

[citation needed] After the relatively mild 1990 recession ended in early 1991, the country hit a belated unemployment rate peak of 7.8% in mid-1992.

However conditions improved, and the Federal Reserve raised interest rates six times between June 1999 and May 2000 in an effort to cool the economy to achieve a soft landing.

[4] According to the National Bureau of Economic Research (NBER), which is the private, nonprofit, nonpartisan organization charged with determining economic recessions, the U.S. economy was in recession from March 2001 to November 2001,[5] a period of eight months at the beginning of President George W. Bush's term of office.

[8] In early 2004, NBER President Martin Feldstein said: It is clear that the revised data have made our original March date for the start of the recession much too late.

[9] From mid-1999 to 2001, the Federal Reserve, in a move to protect the economy from the overvalued stock market, made successive interest rate increases.

Using the stock market as an unofficial benchmark, a recession would have begun in March 2000 when the NASDAQ crashed following the collapse of the dot-com bubble.

Canada's economy is closely linked to that of the United States, and economic conditions south of the border tend to quickly make their way north.

Many provincial governments suffered greater problems with a number of them returning to deficits, which was blamed on the fiscal imbalance.

In August 1998, the value of the ruble fell 34% and people clamored to get their money out of banks (see 1998 Russian financial crisis).

The Bank of Japan attempted to cultivate inflation with high liquidity and a nominal 0% interest rate on loans.

This hurt business for companies based in Europe, as the profits made abroad (especially in the Americas) had an unfavorable exchange rate.

Both economies suffered from global tech crash with the ruling German party introducing the then unpopular austerity, tax cuts and labor reforms nicknamed Hartz concept to boost the German economy in wake of an economic slump that would persist until the mid-2000s with unemployment peaking in early 2005 of 12.7%.

[10] However, some European Union countries – including the United Kingdom – managed to delay sliding into recession until the late 2000s.