Betterment

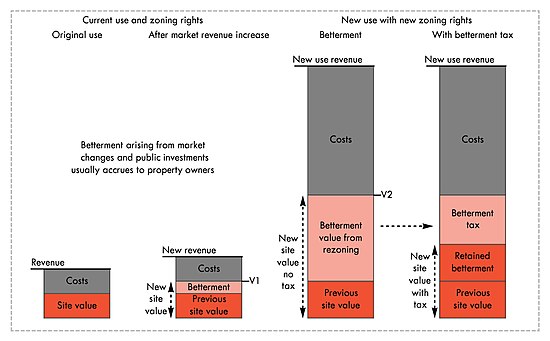

[2] The left column shows the value of the property rights at a site, such as agricultural or industrial land.

That value is determined by the revenue that can be made from exclusively using that site, minus the costs involved in using it.

Its incarnation is the Lease Variation Charge (LVC), which is payable upon an approved development application (though payment timing can be deferred for a period).

[3] The ACT also captures rezoning betterment for the community by deploying a public agency to undertake all the greenfield land development.

[1] The Sydney experience in the 1970s was short-lived only because of organised political pressure of landowners who no longer got windfall gains as the city grew.

In its 2021 budget, the Victorian government proposed a windfall rezoning tax of 50% for the conversion of industrial to high density residential uses.

The "Bogotá model" of betterment levy reflects more a general tax to cover the cost of specific public works.

Issues with the practical determination of betterment values led to the implementation of Certificate of additional construction potential bonds (CEPACs), which are issued by the city and sold by auction in the São Paulo Stock Market Exchange (Bovespa).

"They give the bearer additional building rights such as a larger floor area ratio and footprint and the ability to change uses of the plot.

Financially speaking, CEPACs are the economic compensation a developer gives the public administration in return for new building rights.

Public agencies acquiring major un- and under-developed sites prior to rezoning and master-planning for urban uses, then selling most of the up-zoned properties with new roads and infrastructure for private development.