Negotiable instrument

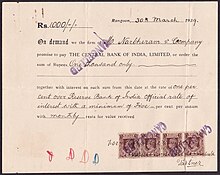

More specifically, it is a document contemplated by or consisting of a contract, which promises the payment of money without condition, which may be paid either on demand or at a future date.

In India, during the Mauryan period in the 3rd century BC, an instrument called adesha was in use, which was an order on a banker desiring him to pay the money of the note to a third person, which corresponds to the definition of a bill of exchange as we understand it today.

[4] Common prototypes of bills of exchanges and promissory notes originated in China, where special instruments called fey tsien which were used to safely transfer money over long distances during the reign of the Tang dynasty in the 8th century.

[6][7] In the mid-13th century, the Ilkhanid rulers of Persia printed the "cha" or "chap" which was used as paper money for limited use for transactions between the court and the merchants for about three years before it collapsed.

Later, such documents were used for money transfer by Middle Eastern merchants, who had used the prototypes of bills of exchange ("suftadja" or "softa") from the 8th century to present.

The first mention of the use of bills of exchange in English statutes dates from 1381, under Richard II; the statute mandates the use of such instruments in England, and prohibits the future export of gold and silver specie, in any form, to settle foreign commercial transactions.

The following chart shows the main differences:[13] Although possibly non-negotiable, a promissory note may be a negotiable instrument if it is an unconditional promise in writing made by one person to another, signed by the maker, engaging to pay on demand to the payee, or at fixed or determinable future time, a sum certain in money, to order or to bearer.

[14] A bill of exchange or "draft" is a written order by the drawer to the drawee to pay money to the payee.

The various state law enactments of UCC §§ 3–104(a) through (d) set forth the legal definition of what is and what is not a negotiable instrument:

(a) Except as provided in subsections (c) and (d), "negotiable instrument" means an unconditional promise or order to pay a fixed amount of money, with or without interest or other charges described in the promise or order, if it: (1) is payable to bearer or to order at the time it is issued or first comes into possession of a holder; (2) is payable on demand or at a definite time; and (3) does not state any other undertaking or instruction by the person promising or ordering payment to do any act in addition to the payment of money, but the promise or order may contain (i) an undertaking or power to give, maintain, or protect collateral to secure payment, (ii) an authorization or power to the holder to confess judgment or realize on or dispose of collateral, or (iii) a waiver of the benefit of any law intended for the advantage or protection of an obligor.

The most common manner in which this is done is by "endorsing" (from Latin dorsum, the back + in[17]), that is placing one's signature on the back of the instrument—if the person who signs does so with the intention of obtaining payment of the instrument or acquiring or transferring rights to the instrument, the signature is called an endorsement.

The holder-in-due-course rule is a rebuttable presumption that makes the free transfer of negotiable instruments feasible in the modern economy.

A person or entity purchasing an instrument in the ordinary course of business can reasonably expect that it will be paid when presented to, and not subject to dishonor by, the maker, without involving itself in a dispute between the maker and the person to whom the instrument was first issued (this can be contrasted to the lesser rights and obligations accruing to mere holders).

Article 3 of the Uniform Commercial Code as enacted in a particular State's law contemplate real defenses available to purported holders in due course.

[19] Negotiability can be traced back to the 1700s and Lord Mansfield, when money and liquidity was relatively scarce.

[11] Concerns have also been raised that the holder in due course rule does not align the incentives of the mortgage originators and the assignees efficiently.