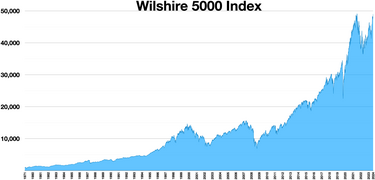

Wilshire 5000

The Wilshire 5000 Total Market Index, or more simply the Wilshire 5000, is a market-capitalization-weighted index of the market value of all American stocks actively traded in the United States.

[1] The index is intended to measure the performance of most publicly traded companies headquartered in the United States, with readily available price data (Bulletin Board/penny stocks and stocks of extremely small companies are excluded).

The full cap index uses the total shares outstanding for each company.

The float-adjusted index uses shares adjusted for free float.

The list of issues included in the index is updated monthly to add new listings resulting from corporate spin-offs and initial public offerings, and to remove issues which move to the pink sheets or that have ceased trading for at least 10 consecutive days.