Box spread

[1] Under the no-arbitrage assumption, the net premium paid out to acquire this position should be equal to the present value of the payoff.

An alternate name is "alligator spread," derived from the large number of trades required to open and close them "eating" one's profit via commission fees.

Most other styles of options, such as American, are less suitable, because they may expose traders to unwanted risk if one or more "legs" of a spread are exercised prematurely.

An arbitrage operation may be represented as a sequence which begins with zero balance in an account, initiates transactions at time t = 0, and unwinds transactions at time t = T so that all that remains at the end is a balance whose value B will be known for certain at the beginning of the sequence.

However, market forces tend to close any arbitrage windows which might open; hence the present value of B is usually insufficiently different from zero for transaction costs to be covered.

This is considered typically to be a "Market Maker/ Floor trader" strategy only, due to extreme commission costs of the multiple-leg spread.

Note that directly exploiting deviations from either of these two parity relations involves purchasing or selling the underlying stock.

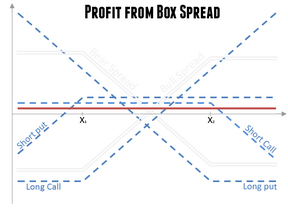

The pay-off for the long box-spread will be the difference between the two strike prices, and the profit will be the amount by which the discounted payoff exceeds the net premium.

[Normally, the discounted payoff would differ little from the net premium, and any nominal profit would be consumed by transaction costs.]

The following table displays the payoffs of the 4 options for the three ranges of values for the terminal stock price

Surveys done by Chaput and Ederington on the Chicago Mercantile Exchange's market for options on Eurodollar futures showed that between 1999 and 2000, some 25% of the trading volume was in outright options, 25% in straddles and vertical spreads (call-spreads and put-spreads), and about 5% in strangles.

[citation needed] Diamond and van Tassel found that the difference between the implied "risk free" rate through box spreads and Treasuries, or similar investments in other countries' central banks, is a "convenience yield" for the ease of investment in the central bank's securities.

[2] In January 2019, a member of the Reddit community /r/WallStreetBets realized a loss of more than $57,000 on $5,000 principal by attempting a box spread through Robinhood, which provides commission-free options trading.

Robinhood subsequently announced that investors on the platform would no longer be able to open box spreads, a policy that remains in place as of October 2022.