Break-even point

[1][2] In economics specifically, the term has a broader definition; even if there is no net loss or gain, and one has "broken even", opportunity costs have been covered and capital has received the risk-adjusted, expected return.

It is only possible for a firm to pass the break-even point if the dollar value of sales is higher than the variable cost per unit.

Break-even points can be useful to all avenues of a business, as it allows employees to identify required outputs and work towards meeting these.

However, it is important that each business develop a break-even point calculation, as this will enable them to see the number of units they need to sell to cover their variable costs.

As a business, they must consider increasing the number of tables they sell annually in order to make enough money to pay fixed and variable costs.

Either option can reduce the break-even point so the business need not sell as many tables as before, and could still pay fixed costs.

The main purpose of break-even analysis is to determine the minimum output that must be exceeded for a business to profit.

A firm can analyze ideal output levels to be knowledgeable on the amount of sales and revenue that would meet and surpass the break-even point.

Identifying a break-even point helps provide a dynamic view of the relationships between sales, costs, and profits.

Any sales made past the breakeven point can be considered profit (after all initial costs have been paid) Break-even analysis can also provide data that can be useful to the marketing department of a business as well, as it provides financial goals that the business can pass on to marketers so they can try to increase sales.

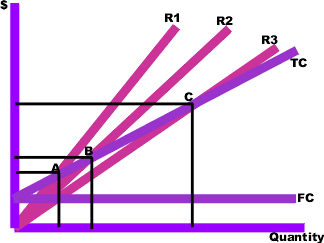

In the linear Cost-Volume-Profit Analysis model (where marginal costs and marginal revenues are constant, among other assumptions), the break-even point (BEP) (in terms of Unit Sales (X)) can be directly computed in terms of Total Revenue (TR) and Total Costs (TC) as: where: The quantity,

sales proceeds) instead of Unit Sales (X), the above calculation can be multiplied by Price, or, equivalently, the Contribution Margin Ratio (Unit Contribution Margin over Price) can be calculated: Where R is revenue generated, C is cost incurred i.e.