Contribution margin

Calculating the contribution margin is an excellent tool for managers to help determine whether to keep or drop certain aspects of the business.

[4] Contribution margin is also one of the factors to judge whether a company has monopoly power in competition law, such as use of the Lerner index test.

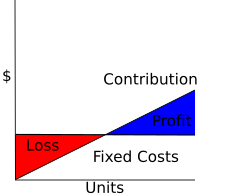

Thus Profit is the Contribution Margin times Number of Units, minus the Total Fixed Costs.

offset, and the Net Income (Profit and Loss) is Total Contribution Margin minus Total Fixed Costs: Combined Profit Volume Ratio can be calculated by using following formula The Beta Company's contribution margin for the year was 34 percent.

Although this shows only the top half of the contribution format income statement, it's immediately apparent that Product Line C is Beta's most profitable one, even though Beta gets more sales revenue from Line B (which is also an example of what is called Partial Contribution Margin - an income statement that references only variable costs).

This is information that can't be gleaned from the regular income statements that an accountant routinely draws up each period.

A surgical suite can schedule itself efficiently but fail to have a positive contribution margin if many surgeons are slow, use too many instruments or expensive implants, etc.

This is because fee-for-service hospitals have a positive contribution margin for almost all elective cases mostly due to a large percentage of OR costs being fixed.