UK rebate

[1][3] Although the rebate was not set in the EU treaties, it was negotiated as part of the Multiannual Financial Framework (MFF) every seven years and had to be unanimously agreed.

Under this system, revenues were to flow automatically to the EC budget rather than through agreement of the national parliaments, as had been the case until then, and calculated based on three elements:[6] As the UK's VAT base in comparison with gross national product (GNP) was proportionally higher than in other member states, and the UK was more open than other member states [7] to trade with non-EC countries, this system implied a disproportionate contribution by the UK when it joined the EEC in 1973.

In 2005, Prime Minister Tony Blair agreed to exclude from the calculation most enlargement-related expenditure (with a progressive phasing-in of the change from 2009 onwards), so as to contribute to the financing of the enlargements to the European Union,[9] with the accession of Central and Eastern European states, that the country itself had strongly supported.

The objective was to address what was widely perceived as an unfair effect of the rebate, since the original mechanism would have resulted in the UK contributing little to the costs of enlargement.

This had the effect of artificially reducing EU expenditure returning to the UK and worsening the deficit which the rebate was intended to redress.

The British government had resisted campaigns to abolish the rebate and the UK had a veto on any decision by the EU to do so.

In addition, they point out that without the rebate, the UK would pay much more into the EU than comparably wealthy countries like France, due to structural differences between their economies.

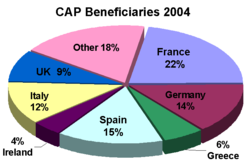

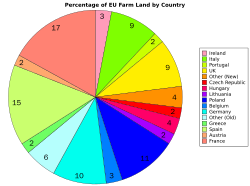

[22] If the rebate was removed without changes to the CAP then the UK would have paid a larger net contribution than France.

[23] Germany has a GDP approximately 25% higher than either France or the UK, but per capita income is comparable to the other two countries.

Britain dismissed this as a diplomatic manoeuvre by France to save face after their rejection of the European Constitution in a referendum two weeks before the meeting.

The UK made CAP reform a prerequisite of removal of the rebate, a proposal their opponents rejected.

[26] Far from this, the Multiannual Financial Framework for the 2021-2027 period will shift €53.2bn as national rebates to Germany and the frugal Four funded by the Member States according to their GNI.