Call option

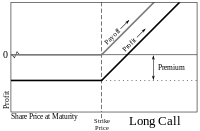

[1] The buyer of the call option has the right, but not the obligation, to buy an agreed quantity of a particular commodity or financial instrument (the underlying) from the seller of the option at or before a certain time (the expiration date) for a certain price (the strike price).

The buyer pays a fee (called a premium) for this right.

The price of the call contract must act as a proxy response for the valuation of: The call contract price generally will be higher when the contract has more time to expire (except in cases when a significant dividend is present) and when the underlying financial instrument shows more volatility or other unpredictability.

Determining this value is one of the central functions of financial mathematics.

The most common method used is the Black–Scholes model, which provides an estimate of the price of European-style options.