Collateralized debt obligation

[4] Distinctively, CDO credit risk is typically assessed based on a probability of default (PD) derived from ratings on those bonds or assets.

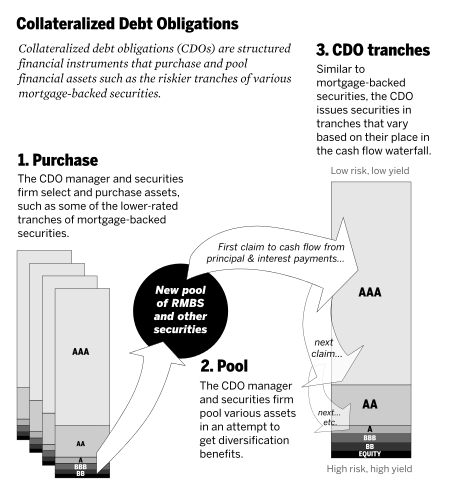

[5] The CDO is "sliced" into sections known as "tranches", which "catch" the cash flow of interest and principal payments in sequence based on seniority.

[6] If some loans default and the cash collected by the CDO is insufficient to pay all of its investors, those in the lowest, most "junior" tranches suffer losses first.

CDO collateral became dominated by high risk (BBB or A) tranches recycled from other asset-backed securities, whose assets were usually subprime mortgages.

[16] In 1974, the Equal Credit Opportunity Act in the United States imposed heavy sanctions for financial institutions found guilty of discrimination on the basis of race, color, religion, national origin, sex, marital status, or age[17] This led to a more open policy of giving loans (sometimes subprime) by banks, guaranteed in most cases by Fannie Mae and Freddie Mac.

[11][39][40][41][42][43] According to the Financial Crisis Inquiry Report, "the CDO became the engine that powered the mortgage supply chain",[11] promoting an increase in demand for mortgage-backed securities without which lenders would have "had less reason to push so hard to make" non-prime loans.

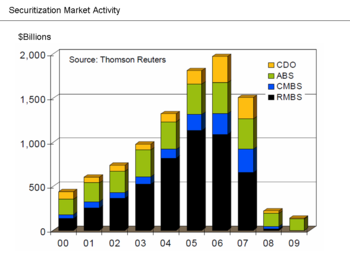

[46][47] The rise of "ratings arbitrage"—i.e., pooling low-rated tranches to make CDOs—helped push sales of CDOs to about $500 billion in 2006,[28] with a global CDO market of over US$1.5 trillion.

Because most traditional mortgage investors are risk-averse, either because of the restrictions of their investment charters or business practices, they are interested in buying the higher-rated segments of the loan stack; as a result, those slices are easiest to sell.

As journalist Gretchen Morgenson put it, CDOs became "the perfect dumping ground for the low-rated slices Wall Street couldn't sell on its own.

[68] Journalist Michael Lewis gave as an example of unsustainable underwriting practices a loan in Bakersfield, California, where "a Mexican strawberry picker with an income of $14,000 and no English was lent every penny he needed to buy a house of $724,000".

[24] Big CDO arrangers like Citigroup, Merrill Lynch and UBS experienced some of the biggest losses, as did financial guaranteers such as AIG, Ambac, MBIA.

[46] Prior to the crisis, a few academics, analysts and investors such as Warren Buffett (who famously disparaged CDOs and other derivatives as "financial weapons of mass destruction, carrying dangers that, while now latent, are potentially lethal"[84]), and the IMF's former chief economist Raghuram Rajan[85] warned that rather than reducing risk through diversification, CDOs and other derivatives spread risk and uncertainty about the value of the underlying assets more widely.

[24] In December 2007, journalists Carrick Mollenkamp and Serena Ng wrote of a CDO called Norma created by Merrill Lynch at the behest of Illinois hedge fund, Magnetar.

"[87][88] According to journalists Bethany McLean and Joe Nocera, no securities became "more pervasive – or [did] more damage than collateralized debt obligations" to create the Great Recession.

[26] Gretchen Morgenson described the securities as "a sort of secret refuse heap for toxic mortgages [that] created even more demand for bad loans from wanton lenders."

CDOs prolonged the mania, vastly amplifying the losses that investors would suffer and ballooning the amounts of taxpayer money that would be required to rescue companies like Citigroup and the American International Group."

"[58] "As usual, the ratings agencies were chronically behind on developments in the financial markets and they could barely keep up with the new instruments springing from the brains of Wall Street's rocket scientists.

Fitch, Moody's, and S&P paid their analysts far less than the big brokerage firms did and, not surprisingly wound up employing people who were often looking to befriend, accommodate, and impress the Wall Street clients in hopes of getting hired by them for a multiple increase in pay.

"[93]Michael Lewis also pronounced the transformation of BBB tranches into 80% triple A CDOs as "dishonest", "artificial" and the result of "fat fees" paid to rating agencies by Goldman Sachs and other Wall Street firms.

To create a CDO, a corporate entity is constructed to hold assets as collateral backing packages of cash flows which are sold to investors.

If a large portion of the mortgages enter default, there is insufficient cash flow to fill all these cups and equity tranche investors face the losses first.

[100] CDOs, like all asset-backed securities, enable the originators of the underlying assets to pass credit risk to another institution or to individual investors.

The key economic consideration for an underwriter that is considering bringing a new deal to market is whether the transaction can offer a sufficient return to the equity noteholders.

Such a determination requires estimating the after-default return offered by the portfolio of debt securities and comparing it to the cost of funding the CDO's rated notes.

Other underwriter responsibilities include working with a law firm and creating the special purpose legal vehicle (typically a trust incorporated in the Cayman Islands) that will purchase the assets and issue the CDO's tranches.

In addition, the underwriter will work with the asset manager to determine the post-closing trading restrictions that will be included in the CDO's transaction documents and other files.

The manager can maintain the credit quality of a CDO's portfolio through trades as well as maximize recovery rates when defaults on the underlying assets occur.

In this role, the collateral administrator produces and distributes noteholder reports, performs various compliance tests regarding the composition and liquidity of the asset portfolios in addition to constructing and executing the priority of payment waterfall models.

The yield and weighted average life of the bonds or equity notes being issued is then calculated based on the modeling assumptions provided by the underwriter.

Example: "A capital market in which asset-backed securities are issued and traded is composed of three main categories: ABS, MBS and CDOs" (italics added).