Competition law

[13] Under Diocletian in 301 A.D., an edict imposed the death penalty for anyone violating a tariff system, for example by buying up, concealing, or contriving the scarcity of everyday goods.

[15] The Domesday Book recorded that "foresteel" (i.e. forestalling, the practice of buying up goods before they reach market and then inflating the prices) was one of three forfeitures that King Edward the Confessor could carry out through England.

[19] Under King Edward III the Statute of Labourers of 1349[20] fixed wages of artificers and workmen and decreed that foodstuffs should be sold at reasonable prices.

On top of existing penalties, the statute stated that overcharging merchants must pay the injured party double the sum he received, an idea that has been replicated in punitive treble damages under US antitrust law.

[21] ... we have ordained and established, that no merchant or other shall make Confederacy, Conspiracy, Coin, Imagination, or Murmur, or Evil Device in any point that may turn to the Impeachment, Disturbance, Defeating or Decay of the said Staples, or of anything that to them pertaineth, or may pertain.In continental Europe, competition principles developed in lex mercatoria.

Examples of legislation enshrining competition principles include the constitutiones juris metallici by Wenceslaus II of Bohemia between 1283 and 1305, condemning combination of ore traders increasing prices; the Municipal Statutes of Florence in 1322 and 1325 followed Zeno's legislation against state monopolies; and under Emperor Charles V in the Holy Roman Empire a law was passed "to prevent losses resulting from monopolies and improper contracts which many merchants and artisans made in the Netherlands".

The court found the grant void and that three characteristics of monopoly were (1) price increase, (2) quality decrease, (3) the rise in unemployment and destitution among artificers.

[29] The development of early competition law in England and Europe progressed with the diffusion of writings such as The Wealth of Nations by Adam Smith, who first established the concept of the market economy.

Following the French Revolution in 1789 the law of 14–17 June 1791 declared agreements by members of the same trade that fixed the price of an industry or labour as void, unconstitutional, and hostile to liberty.

However, as in the late 19th century, a depression spread through Europe, known as the Panic of 1873, ideas of competition lost favour, and it was felt that companies had to co-operate by forming cartels to withstand huge pressures on prices and profits.

[31] The Sherman Act of 1890 attempted to outlaw the restriction of competition by large companies, who co-operated with rivals to fix outputs, prices and market shares, initially through pools and later through trusts.

[31] Vast numbers of citizens became sufficiently aware and publicly concerned about how the trusts negatively impacted them that the Act became a priority for both major parties.

[33] Section 1 of the Sherman Act declared illegal "every contract, in the form of trust or otherwise, or conspiracy, in restraint of trade or commerce among the several States, or with foreign nations."

At a regional level EU competition law has its origins in the European Coal and Steel Community (ECSC) agreement between France, Italy, Belgium, the Netherlands, Luxembourg and Germany in 1951 following the Second World War.

Article 101(3) establishes exemptions, if the collusion is for distributional or technological innovation, gives consumers a "fair share" of the benefit and does not include unreasonable restraints that risk eliminating competition anywhere (or compliant with the general principle of European Union law of proportionality).

[39] The general test is whether a concentration (i.e. merger or acquisition) with a community dimension (i.e. affects a number of EU member states) might significantly impede effective competition.

Article 107 lays down a general rule that the state may not aid or subsidize private parties in distortion of free competition and provides exemptions for charities, regional development objectives and in the event of a natural disaster.

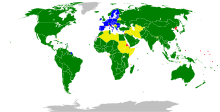

[43] Currently competition authorities of many states closely co-operate, on everyday basis, with foreign counterparts in their enforcement efforts, also in such key area as information / evidence sharing.

While there remains differences between regimes (for example, over merger control notification rules, or leniency policies for whistle-blowers),[47] and it is unlikely that there will be a supranational competition authority for ASEAN (akin to the European Union),[48] there is a clear trend towards increase in infringement investigations or decisions on cartel enforcement.

Office of Fair Trading Director and Richard Whish wrote sceptically that it "seems unlikely at the current stage of its development that the WTO will metamorphose into a global competition authority".

This is the so-called doctrine of Free Trade, which rests on grounds different from, though equally solid with, the principle of individual liberty asserted in this Essay.

This traces to Austrian-American political scientist Joseph Schumpeter's notion that a "perennial gale of creative destruction" is ever sweeping through capitalist economies, driving enterprise at the market's mercy.

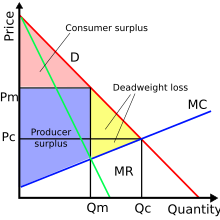

Markets may fail to be efficient for a variety of reasons, so the exception of competition law's intervention to the rule of laissez faire is justified if government failure can be avoided.

[73] Bork argued that both the original intention of antitrust laws and economic efficiency was the pursuit only of consumer welfare, the protection of competition rather than competitors.

[75] Running through the different critiques of US antitrust policy is the common theme that government interference in the operation of free markets does more harm than good.

"[74] Harvard Law School professor Philip Areeda, who favours more aggressive antitrust policy, in at least one Supreme Court case challenged Robert Bork's preference for non-intervention.

[88] However, in France Telecom SA v. Commission[89] a broadband internet company was forced to pay $13.9 million for dropping its prices below its own production costs.

[106] Mergers vertically in the market are rarely of concern, although in AOL/Time Warner[107] the European Commission required that a joint venture with a competitor Bertelsmann be ceased beforehand.

The EU authorities have also focused lately on the effect of conglomerate mergers, where companies acquire a large portfolio of related products, though without necessarily dominant shares in any individual market.

[108] Competition law has become increasingly intertwined with intellectual property, such as copyright, trademarks, patents, industrial design rights and in some jurisdictions trade secrets.