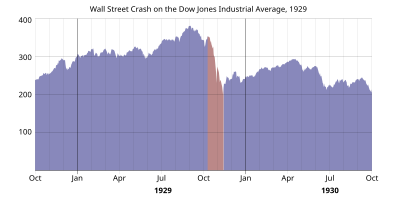

Wall Street crash of 1929

The crash began a rapid erosion of confidence in the U.S. banking system and marked the beginning of the worldwide Great Depression, which lasted until 1939; it is thus considered the most devastating in the country's history.

Many members of the public, disappointed by the low interest rates offered on their bank deposits, committed their relatively small sums to stockbrokers.

Despite these trends, investors continued to buy shares in areas of the economy where output was declining and unemployment was increasing, so the purchase price of stocks greatly exceeded their real value.

By September 1929, more experienced shareholders realized that prices could not continue to rise and began to get rid of their holdings, which caused share values to stall and then fall, encouraging more to sell.

After Black Thursday, leading bankers joined forces to purchase stock at prices above market value, a strategy used during the Panic of 1907.

Building on post-war optimism, rural Americans migrated to the cities in vast numbers throughout the decade with hopes of finding a more prosperous life in the ever-growing expansion of America's industrial sector.

On March 25, 1929, after the Federal Reserve warned of excessive speculation, a small crash occurred as investors started to sell stocks at a rapid pace, exposing the market's shaky foundation.

[7] Two days later, banker Charles E. Mitchell announced that his company, the National City Bank, would provide $25 million in credit to stop the market's slide.

[7] Shortly before the crash, economist Irving Fisher famously proclaimed "Stock prices have reached what looks like a permanently high plateau".

[citation needed] The huge volume meant that the report of prices on the ticker tape in brokerage offices around the nation was hours late, and so investors had no idea what most stocks were trading for.

[citation needed] On October 28, "Black Monday",[19] more investors facing margin calls decided to get out of the market, and the slide continued with a record loss in the Dow for the day of 38.33 points, or 12.82%.

[20] On October 29, 1929, "Black Tuesday" hit Wall Street as investors traded some 16 million shares on the New York Stock Exchange in a single day.

The Dow then embarked on another, much longer, steady slide from April 1930 to July 8, 1932, when it closed at 41.22, its lowest level of the 20th century, concluding an 89.2% loss for the index in less than three years.

[35] Such figures set up a crescendo of stock-exchange speculation that led hundreds of thousands of Americans to invest heavily in the stock market.

In June 1929, the position was saved by a severe drought in the Dakotas and the Canadian West, as well as unfavorable seed times in Argentina and eastern Australia.

[44] The president of the Chase National Bank, Albert H. Wiggin, said at the time: We are reaping the natural fruit of the orgy of speculation in which millions of people have indulged.

[49] The Wall Street Crash had a major impact on the U.S. and world economy, and it has been the source of intense academic historical, economic, and political debate from its aftermath until the present day.

[52] As tentatively expressed by economic historian Charles P. Kindleberger, in 1929, there was no lender of last resort effectively present, which, if it had existed and been properly exercised, would have been key in shortening the business slowdown that normally follows financial crises.

Only 16% of American households were invested in the stock market within the United States during the period leading up to this depression, suggesting that the crash carried somewhat less weight in causing it.

[citation needed] However, the psychological effects of the crash reverberated across the nation as businesses became aware of the difficulties in securing capital market investments for new projects and expansions.

The Wall Street Crash is usually seen as having the greatest impact on the events that followed and therefore is widely regarded as signaling the downward economic slide that initiated the Great Depression.

Most academic experts agree on one aspect of the crash: It wiped out billions of dollars of wealth in one day, and this immediately depressed consumer buying.

[53] The failure set off a worldwide run on US gold deposits (i.e., the dollar) and forced the Federal Reserve to raise interest rates into the slump.

Within the UK, protests often focused on the so-called means test, which the government had instituted in 1931 to limit the amount of unemployment payments made to individuals and families.

The strikes were met forcefully, with police breaking up protests, arresting demonstrators, and charging them with crimes related to the violation of public order.

[59] Milton Friedman and Anna Schwartz's A Monetary History of the United States, argues that what made the "great contraction" so severe was not the downturn in the business cycle, protectionism, or the 1929 stock market crash in themselves but the collapse of the banking system during three waves of panics from 1930 to 1933.