Credit default swap

[7][8][9] In March 2010, the Depository Trust & Clearing Corporation (see Sources of Market Data) announced it would give regulators greater access to its credit default swaps database.

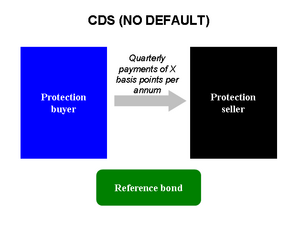

The buyer makes periodic payments to the seller, and in return receives a payoff if an underlying financial instrument defaults or experiences a similar credit event.

[18] Critics assert that naked CDSs should be banned, comparing them to buying fire insurance on your neighbor's house, which creates a huge incentive for arson.

[35] Financier George Soros called for an outright ban on naked credit default swaps, viewing them as "toxic" and allowing speculators to bet against and "bear raid" companies or countries.

[39][40] Despite these concerns, former United States Secretary of the Treasury Geithner[18][39] and Commodity Futures Trading Commission Chairman Gensler[41] are not in favor of an outright ban on naked credit default swaps.

Because the borrower—the reference entity—is not a party to a credit default swap, entering into a CDS allows the bank to achieve its diversity objectives without impacting its loan portfolio or customer relations.

To manage the risk of losing money if Risky Corp defaults on its debt, the pension fund buys a CDS from Derivative Bank in a notional amount of $10 million.

Another common arbitrage strategy aims to exploit the fact that the swap-adjusted spread of a CDS should trade closely with that of the underlying cash bond issued by the reference entity.

This changed when CDS's began to be traded as securities from JPMorgan, an effort led by Bill Demchak where he and his team created bundles of swaps and sold them to investors.

[53] In 1997, JPMorgan developed a proprietary product called BISTRO (Broad Index Securitized Trust Offering) that used CDS to clean up a bank's balance sheet.

The market for Credit Default Swaps attracted considerable concern from regulators after a number of large scale incidents in 2008, starting with the collapse of Bear Stearns.

It has been suggested that this widening was responsible for the perception that Bear Stearns was vulnerable, and therefore restricted its access to wholesale capital, which eventually led to its forced sale to JP Morgan in March.

[72][notes 1] Bloomberg's Terhune (2010) explained how investors seeking high-margin returns use Credit Default Swaps (CDS) to bet against financial instruments owned by other companies and countries.

Intercontinental's clearing houses guarantee every transaction between buyer and seller providing a much-needed safety net reducing the impact of a default by spreading the risk.

[72] Brookings senior research fellow, Robert E. Litan, cautioned however, "valuable pricing data will not be fully reported, leaving ICE's institutional partners with a huge informational advantage over other traders.

He calls ICE Trust "a derivatives dealers' club" in which members make money at the expense of nonmembers (Terhune citing Litan in Bloomberg Business Week 2010-07-29).

[74] A derivatives analyst at Morgan Stanley, one of the backers for IntercontinentalExchange's subsidiary, ICE Trust in New York, launched in 2008, claimed that the "clearinghouse, and changes to the contracts to standardize them, will probably boost activity".

The early months of 2009 saw several fundamental changes to the way CDSs operate, resulting from concerns over the instruments' safety after the events of the previous year.

[51][77] The SEC's approval for ICE Futures' request to be exempted from rules that would prevent it clearing CDSs was the third government action granted to Intercontinental in one week.

On March 3, its proposed acquisition of Clearing Corp., a Chicago clearinghouse owned by eight of the largest dealers in the credit-default swap market, was approved by the Federal Trade Commission and the Justice Department.

SEC spokesperson John Nestor stated For several months the SEC and our fellow regulators have worked closely with all of the firms wishing to establish central counterparties.... We believe that CME should be in a position soon to provide us with the information necessary to allow the commission to take action on its exemptive requests.Other proposals to clear credit-default swaps have been made by NYSE Euronext, Eurex AG and LCH.Clearnet Ltd. Only the NYSE effort is available now for clearing after starting on Dec. 22.

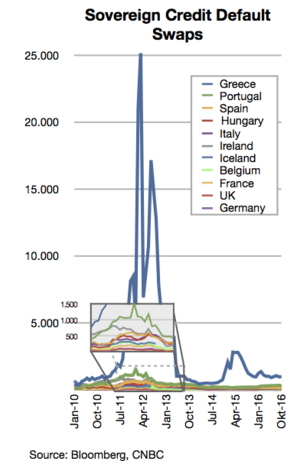

The European sovereign debt crisis resulted from a combination of complex factors, including the globalisation of finance; easy credit conditions during the 2002–2008 period that encouraged high-risk lending and borrowing practices; the 2007–2008 financial crisis; international trade imbalances; real estate bubbles that have since burst; the Great Recession; fiscal policy choices related to government revenues and expenses; and approaches used by nations to bail out troubled banking industries and private bondholders, assuming private debt burdens or socialising losses.

During the auction process participating dealers (e.g., the big investment banks) submit prices at which they would buy and sell the reference entity's debt obligations, as well as net requests for physical settlement against par.

According to the International Swaps and Derivatives Association (ISDA), who organised them, auctions have recently proved an effective way of settling the very large volume of outstanding CDS contracts written on companies such as Lehman Brothers and Washington Mutual.

[90] Commentator Felix Salmon, however, has questioned in advance ISDA's ability to structure an auction, as defined to date, to set compensation associated with a 2012 bond swap in Greek government debt.

[108] Berkshire Hathaway was a large owner of Moody's stock during the period that it was one of two primary rating agencies for subprime CDOs, a form of mortgage security derivative dependent on the use of credit default swaps.

[111][112][113] During the 2007–2008 financial crisis, counterparties became subject to a risk of default, amplified with the involvement of Lehman Brothers and AIG in a very large number of CDS transactions.

[120] As the outcome of its study, the IRS issued proposed regulations in 2011 specifically classifying CDS as notional principal contracts, and thereby qualifying such termination and sale payments for favorable capital gains tax treatment.

[121] These proposed regulations, which are yet to be finalized, have already been subject to criticism at a public hearing held by the IRS in January 2012,[122] as well as in the academic press,[123] insofar as that classification would apply to Naked CDS.

The thrust of this criticism is that Naked CDS are indistinguishable from gambling wagers, and thus give rise in all instances to ordinary income, including to hedge fund managers on their so-called carried interests,[123] and that the IRS exceeded its authority with the proposed regulations.