Currency swap

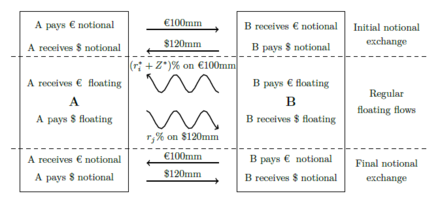

A cross-currency swap's (XCS's) effective description is a derivative contract, agreed between two counterparties, which specifies the nature of an exchange of payments benchmarked against two interest rate indexes denominated in two different currencies.

This is done to maintain a swap whose MTM value remains neutral and does not become either a large asset or liability (due to FX rate fluctuations) throughout its life.

To completely determine any XCS a number of parameters must be specified for each leg; the notional principal amount (or varying notional schedule including exchanges), the start and end dates and date scheduling, the chosen floating interest rate indexes and tenors, and day count conventions for interest calculations.

As OTC instruments, cross-currency swaps (XCSs) can be customised in a number of ways and can be structured to meet the specific needs of the counterparties.

It will then deliver the £100 million to the swap bank who will pass it on to the U.S. Piper Company to finance the construction of its British distribution center.

Depending upon the terms of the CSA, the type of posted collateral that is permitted might become more or less expensive due to other extraneous market movements.

Due to regulations set out in the Basel III Regulatory Frameworks trading interest rate derivatives commands a capital usage.

Dependent upon their specific nature XCSs might command more capital usage and this can deviate with market movements.

[6] In the 1990s Goldman Sachs and other US banks offered Mexico, currency swaps and loans using Mexican oil reserves as collateral and as a means of payment.

In May 2011, Charles Munger of Berkshire Hathaway Inc. accused international investment banks of facilitating market abuse by national governments.

For example, "Goldman Sachs helped Greece raise US$1 billion of off- balance-sheet funding in 2002 through a currency swap, allowing the government to hide debt.

"[7] Greece had previously succeeded in getting clearance to join the euro on 1 January 2001, in time for the physical launch in 2002, by faking its deficit figures.

[8] Currency swaps were originally conceived in the 1970s to circumvent foreign exchange controls in the United Kingdom.

The concept of the interest rate swap was developed by the Citicorp International Services unit in 1980 but cross-currency interest rate swaps were introduced by the World Bank in 1981 to obtain Swiss francs and German marks by exchanging cash flows with IBM.

[14] The People's Republic of China has multiple year currency swap agreements of the Renminbi with Argentina, Belarus, Brazil, Hong Kong, Iceland, Indonesia, Malaysia, Russia, Singapore, South Korea, United Kingdom and Uzbekistan that perform a similar function to central bank liquidity swaps.

[15][16][17][18] South Korea and Indonesia signed a won-rupiah currency swap deal worth US$10 billion in October, 2013.

In August 2018, Qatar and Turkey's central banks signed a currency swap agreement to provide liquidity and support for financial stability.