Dollar cost averaging

In recent years, however, confusion of the term "dollar cost averaging" with what Vanguard call a systematic implementation plan has arisen.

This confusion of terms is perpetuated by some articles that refer to this systematic (delayed) investing of a lump sum as DCA.

Industry practice is to refer to such strategies as dollar-cost averaging; however, this term is also commonly used to describe fixed-dollar investments made over time from current income as it becomes available.

(A familiar example of this form of dollar-cost averaging is regular payroll deductions for investment in a workplace retirement plan.)

"[6] However, in other publications, Vanguard appear to have given up on clarifying the error and simply refer to the systematic (delayed) strategy as "dollar-cost averaging".

[9][10] Additional confusion arises in situations where there is no windfall gain, but instead an investor seeks to make a large change in the asset allocation of their existing investments.

The pros and cons of DCA have long been a subject for debate among both commercial and academic specialists in investment strategies.

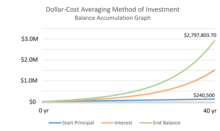

[11] It is easily demonstrated mathematically that dollar cost averaging (as defined by Benjamin Graham) is superior to the alternatives of purchasing a fixed number of shares with the same time intervals.

While some financial advisors, such as Suze Orman,[12] advise the use of DCA, others, such as Timothy Middleton, claim it is nothing more than a marketing gimmick and not a sound investment strategy.

[13] Almost all recent discussion and debate about DCA is actually based on confusion with the situation of the investment of a windfall, even though this is actually a rare event for most investors.

The disservice arises when these investors take these misunderstood criticisms of DCA to mean that timing the market is better than continuously and automatically investing a portion of their income as they earn it.

For example, stopping one's retirement investment contributions during a declining market on account of the argued weaknesses of DCA would indicate a misunderstanding of those arguments.

The financial costs and benefits of systematic (delayed) investing have also been examined in many studies using real market data.

[19] One study found that the best time horizon when delaying investing a windfall in the stock market in terms of balancing return and risk is 6 or 12 months.