Euro

The Eurosystem participates in the printing, minting and distribution of euro banknotes and coins in all member states, and the operation of the eurozone payment systems.

The following six EU member states, representing almost 100 million people, committed themselves in their respective Treaty of Accession to adopt the euro.

In Community legislative acts the plural forms of euro and cent are spelled without the s, notwithstanding normal English usage.

To avoid the use of the two smallest coins, some cash transactions are rounded to the nearest five cents in the Netherlands and Ireland[37][38] (by voluntary agreement) and in Finland and Italy (by law).

The front of the note features windows or gateways while the back has bridges, symbolising links between states in the union and with the future.

[55] Credit/debit card charging and ATM withdrawals within the eurozone are also treated as domestic transactions; however paper-based payment orders, like cheques, have not been standardised so these are still domestic-based.

They could not be set earlier, because the ECU depended on the closing exchange rate of the non-euro currencies (principally pound sterling) that day.

The earliest date was in Germany, where the mark officially ceased to be legal tender on 31 December 2001, though the exchange period lasted for two months more.

The earliest coins to become non-convertible were the Portuguese escudos, which ceased to have monetary value after 31 December 2002, although banknotes remained exchangeable until 2022.A special euro currency sign (€) was designed after a public survey had narrowed ten of the original thirty proposals down to two.

The authors conclude that the crisis "is as much political as economic" and the result of the fact that the euro area lacks the support of "institutional paraphernalia (and mutual bonds of solidarity) of a state".

[71][72] The euro is the sole currency of 20 EU member states: Austria, Belgium, Croatia, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Portugal, Slovakia, Slovenia, and Spain.

[73] According to bilateral agreements with the EU, the euro has also been designated as the sole and official currency in a further four European microstates awarded minting rights (Andorra, Monaco, San Marino and the Vatican City).

All but one (Denmark) current, and any potential future EU members, are obliged to adopt the euro when economic conditions permit.

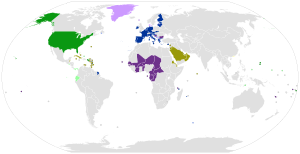

These states are:[citation needed] North America Europe Oceania Africa Since its introduction in 1999, the euro has been the second most widely held international reserve currency after the U.S. dollar.

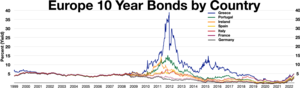

[87] However the Greek government-debt crisis led to former British Foreign Secretary Jack Straw claiming the eurozone could not last in its current form.

It was a nice idea, but by 2004 the two biggest economies in the euro zone, Germany and France, had broken the rules for three years in a row.

[89]Increasing business cycle divergence across the Eurozone over the last decades implies a decreasing Optimum Currency Area.

[92] Before the introduction of the euro, some countries had successfully contained inflation, which was then seen as a major economic problem, by establishing largely independent central banks.

[93] The euro has come under criticism due to its regulation, lack of flexibility and rigidity towards sharing member states on issues such as nominal interest rates.

Increased purchases abroad and negative current account balances can be financed without a problem as long as credit is cheap.

[95] The need to finance trade deficit weakens currency, making exports automatically more attractive in a country and abroad.

[97] A 2009 consensus from the studies of the introduction of the euro concluded that it has increased trade within the eurozone by 5% to 10%,[98] and a meta-analysis of all available studies on the effect of introduction of the euro on increased trade suggests that the prevalence of positive estimates is caused by publication bias and that the underlying effect may be negligible.

[99] Although a more recent meta-analysis shows that publication bias decreases over time and that there are positive trade effects from the introduction of the euro, as long as results from before 2010 are taken into account.

[100] Furthermore, older studies based on certain methods of analysis of main trends reflecting general cohesion policies in Europe that started before, and continue after implementing the common currency find no effect on trade.

[103] Regarding foreign direct investment, a study found that the intra-eurozone FDI stocks have increased by about 20% during the first four years of the EMU.

[97] It has been found that the introduction of the euro created "significant reductions in market risk exposures for nonfinancial firms both in and outside Europe".

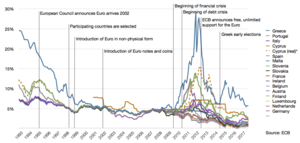

The effect of declining interest rates, combined with excess liquidity continually provided by the ECB, made it easier for banks within the countries in which interest rates fell the most, and their linked sovereigns, to borrow significant amounts (above the 3% of GDP budget deficit imposed on the eurozone initially) and significantly inflate their public and private debt levels.

In the years following the Single European Act, the EU has liberalised its capital markets and, as the ECB has inflation targeting as its monetary policy, the exchange-rate regime of the euro is floating.

[126][127][128] Besides the economic motivations to the introduction of the euro, its creation was also partly justified as a way to foster a closer sense of joint identity between European citizens.

[137] The word 'euro' is pronounced differently according to pronunciation rules in the individual languages applied; in German [ˈɔʏʁo], in English /ˈjʊəroʊ/, in French [øʁo], etc.

Note: The Belarusian rouble is pegged to the euro, Russian rouble and US dollar in a currency basket .