Monetary policy

Interest-rate targeting is generally the primary tool, being obtained either directly via administratively changing the central bank's own interest rates or indirectly via open market operations.

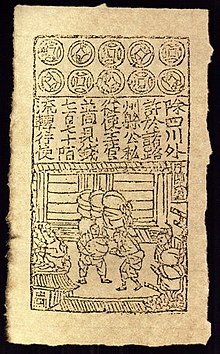

In the later course of the dynasty, facing massive shortages of specie to fund war and maintain their rule, they began printing paper money without restrictions, resulting in hyperinflation.

With the creation of the Bank of England in 1694,[7] which was granted the authority to print notes backed by gold, the idea of monetary policy as independent of executive action[how?]

[8] The purpose of monetary policy was to maintain the value of the coinage, print notes which would trade at par to specie, and prevent coins from leaving circulation.

These included Milton Friedman who early in his career advocated that government budget deficits during recessions be financed in equal amount by money creation to help to stimulate aggregate demand for production.

However, when U.S. Federal Reserve Chairman Paul Volcker tried this policy, starting in October 1979, it was found to be impractical, because of the unstable relationship between monetary aggregates and other macroeconomic variables, and similar results prevailed in other countries.

An expansionary policy decreases short-term interest rates, affecting broader financial conditions to encourage spending on goods and services, in turn leading to increased employment.

[21] Contractionary policy works in the opposite direction: Increasing interest rates will depress borrowing and spending by consumers and businesses, dampening inflationary pressure in the economy together with employment.

Though unless they are selling or taking out new loans their cash flow is unaffected, asset owners feel less wealthy (the wealth effect) and reduce spending.

[34][35] This allows the central bank to control both the quantity of lending and its allocation towards certain strategic sectors of the economy, for example to support the national industrial policy, or to environmental investment such as housing renovation.

Virtues of such money shocks include the decrease of household risk aversion and the increase in demand, boosting both inflation and the output gap.

A nominal anchor is a variable that is thought to bear a stable relationship to the price level or the rate of inflation over some period of time.

It is used in, among other countries, Australia, Brazil, Canada, Chile, Colombia, the Czech Republic, Hungary, Japan, New Zealand, Norway, Iceland, India, Philippines, Poland, Sweden, South Africa, Turkey, and the United Kingdom.

[62] However, critics contend that there are unintended consequences to this approach such as fueling the increase in housing prices and contributing to wealth inequalities by supporting higher equity values.

Under a system of fixed convertibility, currency is bought and sold by the central bank or monetary authority on a daily basis to achieve the target exchange rate.

Countries may decide to use a fixed exchange rate monetary regime in order to take advantage of price stability and control inflation.

Central banks might choose to set a money supply growth target as a nominal anchor to keep prices stable in the long term.

Divisia monetary aggregates developed by Barnett (1980),[66] which appropriately weight components based on their user costs and liquidity services, demonstrate more stable relationships with economic variables.

The classical view holds that international macroeconomic interdependence is only relevant if it affects domestic output gaps and inflation, and monetary policy prescriptions can abstract from openness without harm.

[76][77] The violation or distortion of these assumptions found in empirical research is the subject of a substantial part of the international optimal monetary policy literature.

[79] The consequence is a departure from the classical view in the form of a trade-off between output gaps and misalignments in international relative prices, shifting monetary policy to CPI inflation control and real exchange rate stabilization.

Second, another specificity of international optimal monetary policy is the issue of strategic interactions and competitive devaluations, which is due to cross-border spillovers in quantities and prices.

Even though the real exchange rate absorbs shocks in current and expected fundamentals, its adjustment does not necessarily result in a desirable allocation and may even exacerbate the misallocation of consumption and employment at both the domestic and global level.

Hence, the optimal monetary policy in this case consists of redressing demand imbalances and/or correcting international relative prices at the cost of some inflation.

Beginning with New Zealand in 1990, central banks began adopting formal, public inflation targets with the goal of making the outcomes, if not the process, of monetary policy more transparent.

[86][87][88] In the continuation to a famous speech by former Bank of England governor Mark Carney in September 2015,[89] central bank have justified this work by the fact that climate change will likely generate more volatility in certain markets, some inflationary pressure either due to climate shocks and extreme weather events[90] and linked with an overly slow and disordered transition, and generate climate-related financial risks on the financial sector.

[96] In 2021, the European Central Bank has announced that it will "tilt" its corporate bond purchases (effectively implementing a form of Green QE) and look at ways to incorporate climate factors in its collateral framework.

[99][100][101] However, as studied by the field of behavioral economics that takes into account the concept of bounded rationality, people often deviate from the way that these neoclassical theories assume.

[103] Another common finding in behavioral studies is that individuals regularly offer estimates of their own ability, competence, or judgments that far exceed an objective assessment: they are overconfident.

Monetary policy analyses should thus account for the fact that policymakers (or central bankers) are individuals and prone to biases and temptations that can sensibly influence their ultimate choices in the setting of macroeconomic and/or interest rate targets.