Put option

The purchase of a put option is interpreted as a negative sentiment about the future value of the underlying stock.

Puts may also be combined with other derivatives as part of more complex investment strategies, and in particular, may be useful for hedging.

Another use is for speculation: an investor can take a short position in the underlying stock without trading in it directly.

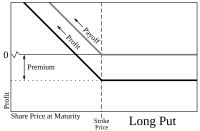

The put buyer either believes that the underlying asset's price will fall by the exercise date or hopes to protect a long position in it.

The advantage of buying a put over short selling the asset is that the option owner's risk of loss is limited to the premium paid for it, whereas the asset short seller's risk of loss is unlimited (its price can rise greatly, in fact, in theory it can rise infinitely, and such a rise is the short seller's loss).

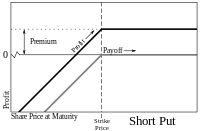

The put 'writer' believes that the underlying security's price will rise, not fall.

Puts can be used also to limit the writer's portfolio risk and may be part of an options spread.

This strategy is best used by investors who want to accumulate a position in the underlying stock, but only if the price is low enough.

But if the stock's market price is above the option's strike price at the end of expiration day, the option expires worthless, and the owner's loss is limited to the premium (fee) paid for it (the writer's profit).

If it does, it becomes more costly to close the position (repurchase the put, sold earlier), resulting in a loss.

If the buyer exercises their option, the writer will buy the stock at the strike price.