Fair value accounting and the subprime mortgage crisis

When the market for such securities became volatile and collapsed, the resulting loss of value had a major financial effect upon the institutions holding them even if they had no immediate plans to sell them.

[3] Fair-value accounting or "Mark-to-Market" is defined by FAS 157 as "a price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date".

The definition is accompanied by a framework which categorize different types of assets and liabilities into 3 levels, and their measurement varied accordingly.

The large-scale use of derivatives by large and medium-sized corporations, together with the ever growing importance of capital markets, has led to major changes in the traditional practices used to prepare financial statements.

Investors demanded increased transparency, and historical cost accounting was blamed for creating rooms for banks to underestimate their losses.

Ultimately, most of the assets held by financial institutions were either not subject to fair value, or did not impact the income statement or balance sheet accounts.

However, as the crisis evolved and liquidity deteriorated, fair value assets held by banks increasingly became Level 3 inputs because their market prices became unobservable.

[4] One of the causes: Brian Wesbury, Chief Economist, and Robert Stein, Senior Economist at First Trust Advisors in their “Economic Commentary” claimed that “It is true that the root of this crisis is bad mortgage loans, but probably 70% of the real crisis that we face today is caused by mark-to-market accounting in an illiquid market".

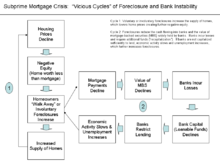

They claim that fair-value accounting contributed to excessive leverage used by banks during boom period, and led to a downward spiral during bust period, forcing banks to value assets at “fire-sale” prices, creating a much lower than necessary valuation of subprime assets, which caused contagion and engendered the tightened lending.

Opponents, such as FDIC chairman William Isaac and House Speaker Newt Gingrich, lobbied and urged for the suspension of mark-to-market accounting.

[6] One argument is that a majority of structured debt, corporate bonds and mortgages were still performing, but their prices had fallen below their true value due to frozen markets (contagion as discussed above).

[7] Opponents also state that fair value accounting undermines critical foundations of financial reporting, including verifiability, reliability and conservatism.

[8] Some opponents may even suggest that historical cost accounting is more accurate by arguing that financial institutions are forced to record any permanent impairment in the market value of their assets.

The fire sale created an excess supply which further drove down the market price of mortgage-backed assets and the regulatory capital of banks continued to decline.

Indeed, the difference between amortized cost and fair value captures the expected impact of current economic conditions on existing financial instruments.

This dual presentation in financial statements — which some investors have asked for—would ensure that both relevant measures are given adequate attention by banks and their auditors.