Fiscal conservatism

[4] In his Reflections on the Revolution in France, Edmund Burke argued that a government does not have the right to run up large debts and then throw the burden on the taxpayer, writing "it is to the property of the citizen, and not to the demands of the creditor of the state, that the first and original faith of civil society is pledged.

The fortunes of individuals, whether possessed by acquisition or by descent or in virtue of a participation in the goods of some community, were no part of the creditor's security, expressed or implied.

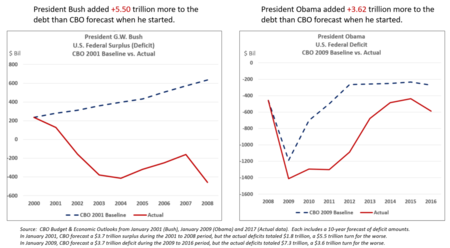

[8] However, the Congressional Budget Office has consistently reported that income tax cuts increase deficits and debt and do not pay for themselves.

However, his actions may have been due more to a sense of federalism than fiscal conservatism as Robert Sobel notes: "As Governor of Massachusetts, Coolidge supported wages and hours legislation, opposed child labor, imposed economic controls during World War I, favored safety measures in factories, and even worker representation on corporate boards".

He promoted government intervention during the early Great Depression, a policy that his successor, Democratic President Franklin D. Roosevelt, continued and increased[22] despite campaigning to the contrary.

[24] In 1977, Democratic President Jimmy Carter appointed Alfred E. Kahn, a professor of economics at Cornell University, to be chair of the Civil Aeronautics Board (CAB).

He was part of a push for deregulation of the industry, supported by leading economists, leading think tanks in Washington, a civil society coalition advocating the reform (patterned on a coalition earlier developed for the truck-and-rail-reform efforts), the head of the regulatory agency, Senate leadership, the Carter administration and even some in the airline industry.

The main purpose of the act was to remove government control over fares, routes and market entry of new airlines from commercial aviation.

[27] Public debt as a percentage of GDP fell rapidly in the post-World War II period and reached a low in 1974 under Richard Nixon.

The United States national debt rose during the 1980s as Ronald Reagan cut tax rates and increased military spending.

[34] Real GDP growth recovered strongly after the 1982 recession, growing at an annual rate of 3.4% for the rest of his time in office.

[36] According to a United States Department of the Treasury nonpartisan economic study, the major tax bills enacted under Reagan caused federal revenue to fall by an amount equal to roughly 1% of GDP.

[37] Although Reagan did not offset the increase in federal government spending or reduce the deficit, his accomplishments are more notable when expressed as a percent of the gross domestic product.

Despite significant campaign stumbles and the uphill struggles involved in mounting a third-party candidacy, Perot received 18.9% of the popular vote (the largest percentage of any third-party candidate in modern history), largely on the basis of his central platform plank of limited-government, balanced-budget fiscal conservatism.

Although not supportive of the wide range tax cut policies that were often enacted during the Reagan and Bush administrations,[41][42] the New Democrat coalition's primary economic agenda differed from the traditional philosophy held by liberal Democrats and sided with the fiscal conservative belief that a balanced federal budget should take precedence over some spending programs.

[42] Former President Bill Clinton, who was a New Democrat and part of the somewhat fiscally conservative Third Way advocating Democratic Leadership Council, is a prime example of this as his administration along with the Democratic-majority congress of 1993 passed on a party-line vote the Omnibus Budget Reconciliation Act of 1993 which cut government spending, created a 36% individual income tax bracket, raised the top tax bracket which encompassed the top 1.2% earning taxpayers from 31% to 39.6% and created a 35% income tax rate for corporations.

Additionally during the Clinton years, the PAYGO (pay-as-you-go) system originally introduced with the passing of the Budget Enforcement Act of 1990 (which required that all increases in direct spending or revenue decreases be offset by other spending decreases or revenue increases and was very popular with deficit hawks) had gone into effect and was used regularly until the system's expiration in 2002.

[44] In the 1994 midterm elections, Republicans ran on a platform that included fiscal responsibility drafted by then-Congressman Newt Gingrich called the Contract with America which advocated such things as balancing the budget, providing the President with a line-item veto and welfare reform.

[45][46][47] American businessman, politician and former Mayor of New York City Michael Bloomberg considers himself a fiscal conservative and expressed his definition of the term at the 2007 British Conservative Party Conference, stating: To me, fiscal conservatism means balancing budgets – not running deficits that the next generation can't afford.

[48]While the term "fiscal conservatism" would imply budget deficits would be lower under conservatives (i.e., Republicans), this has not historically been the case.

They wrote that higher budget deficits should theoretically have boosted the economy more for Republicans, and therefore cannot explain the greater GDP growth under Democrats.

[51] In Canada, the rise of the socialist Co-operative Commonwealth Federation pushed the Liberal Party to create and expand the welfare state before and after World War II.