Flat rate (finance)

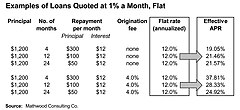

However, if repayment is scheduled to occur at regular intervals throughout the term, the average amount to which the borrower has access is lower and so the effective or true rate of interest is higher.

Loans with interest quoted using a flat rate originated before currency was invented and continued to feature regularly up to and beyond the 20th century within developed countries.

Since $100 in principal is being paid each month, the average amount to which the borrower has access during the loan term is approximately half, in fact just over $600.

The total cost of this loan is the principal plus $48.00 in interest, whilst the average amount outstanding was approximately $600.

As these fees represent an inherent cost of borrowing, they must also be added to the charge for interest in order to show the effective APR.

As a result, Brigit Helms argues for an evolutionary approach to interest rates, in which they can be expected to gradually drop as competition increases and the government gains greater capacity to effectively enforce comparable interest rate disclosures on financial sector actors.