Government bond

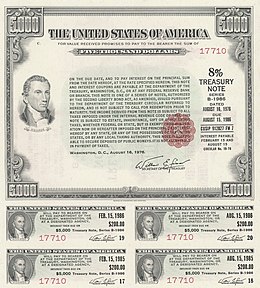

It generally includes a commitment to pay periodic interest, called coupon payments, and to repay the face value on the maturity date.

For example, a bondholder invests $20,000, called face value or principal, into a 10-year government bond with a 10% annual coupon; the government would pay the bondholder 10% interest ($2000 in this case) each year and repay the $20,000 original face value at the date of maturity (i.e. after 10 years).

All bonds carry default risk; that is, the possibility that the government will be unable to pay bondholders.

Governments close to a default are sometimes referred to as being in a sovereign debt crisis.

During the American Revolution, in order to raise money, the U.S. government started to issue bonds - called loan certificates.

The total amount generated by bonds was $27 million and helped finance the war.

A bond paying in a currency that does not have a history of keeping its value may not be a good deal even if a high interest rate is offered.

If a central bank purchases a government security, such as a bond or treasury bill, it increases the money supply because a Central Bank injects liquidity (cash) into the economy.

These actions of increasing or decreasing the amount of money in the banking system are called monetary policy.

They are fixed-interest securities issued by the British government in order to raise money.

[9] UK gilts have maturities stretching much further into the future than other European government bonds, which has influenced the development of pension and life insurance markets in the respective countries.

TreasuryDirect is the official website where investors can purchase treasury securities directly from the U.S. government.

This online system allow investors to save money on commissions and fees taken with traditional channels.