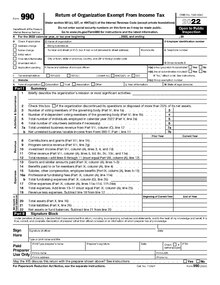

Form 990

The form is due to the IRS 15th day of the 5th month after the end of the foundation's fiscal year.

[6] Form 990 is due on the 15th of the fifth month after the organization's fiscal year ends, with the option for a single six-month extension.

These suggestions go beyond Sarbanes-Oxley requirements for nonprofits to adopt whistleblower and document retention policies.

[8] According to section 1223(b) of the Pension Protection Act of 2006, a nonprofit organization that does not file annual returns or notices for three consecutive years will have its tax-exempt status revoked as of the due date of the third return or notice.

[13] A school below college level affiliated with a church or operated by a religious order may be exempt from the requirement to file Form 990.

In accordance with the Taxpayer First Act of 2019, the Form 990 must be filed electronically, not by mail, for all fiscal years beginning on or after July 1, 2019.

[17] There is a penalty of $20 per day that an organization fails to make its Forms 990 publicly available.

[19]: 229 Public Inspection IRC 6104(d) regulations state that an organization must provide copies of its three most recent Forms 990 to anyone who requests them, whether in person, by mail, fax, or e-mail.

Two are part of the Statistics of Income program: Form 990 was first used for the tax year ending in 1941.

[19] In 1969, Congress passed a law requiring the reporting of the compensation paid to officers by 501(c)(3) organizations.

[19] The increase in pages was due to use of a larger font size and the inclusion of sections that are only required for certain organizations.

[19] In June 2007, the IRS released a revised Form 990 that requires significant disclosures on corporate governance and boards of directors.

[41] On September 6, the IRS issued proposed regulations that would again suspend the requirement for affected organizations to disclose their donors on Schedule B and allow the public to comment on the new procedure in compliance with the Administrative Procedure Act.

Reckhow expressed concern about the lack of corresponding public data available if philanthropic funders moved away from nonprofits to LLCs such as the Chan Zuckerberg Initiative.