Impossible trinity

[1] Historically in advanced economies, the periods pre-1914 were characterized by stable foreign exchange rates and free capital movement, whereas monetary autonomy was limited.

By contrast, Harvard economist Dani Rodrik advocates the use of the third option (c) in his book The Globalization Paradox, emphasising that world GDP grew fastest during the Bretton Woods era when capital controls were accepted in mainstream economics.

Rodrik also argues that the expansion of financial globalization and the free movement of capital flows are the reason why economic crises have become more frequent in both developing and advanced economies alike.

Rodrik has also developed the political trilemma of the world economy where "democracy, national sovereignty and global economic integration are mutually incompatible: we can combine any two of the three, but never have all three simultaneously and in full.

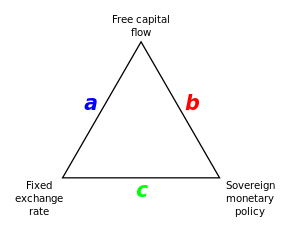

The idea of the impossible trinity went from theoretical curiosity to becoming the foundation of open economy macroeconomics in the 1980s, by which time capital controls had broken down in many countries, and conflicts were visible between pegged exchange rates and monetary policy autonomy.

While one version of the impossible trinity is focused on the extreme case – with a perfectly fixed exchange rate and a perfectly open capital account, a country has absolutely no autonomous monetary policy – the real world has thrown up repeated examples where the capital controls are loosened, resulting in greater exchange rate rigidity and less monetary-policy autonomy.

To start with they posit a nation with a fixed exchange rate at equilibrium with respect to capital flows as its monetary policy is aligned with the international market.

Because the internationally available interest rate adjusted for foreign exchange differences has not changed, market participants are able to make a profit by borrowing in the country's currency and then lending abroad – a form of carry trade.

[7] A 2022 study of the Classical Gold Standard period found that the behavior of advanced economies to international shocks was consistent with the impossible trilemma.

Hence, there are few important countries with an effective system of capital controls, though by early 2010, there has been a movement among economists, policy makers and the International Monetary Fund back in favour of limited use.

[9][10][11] Lacking effective control on the free movement of capital, the impossible trinity asserts that a country has to choose between reducing currency volatility and running a stabilising monetary policy: it cannot do both.